_______ is the additional cost which is added to the cost price of an item.

A. Interest

B. Cost

C. Overhead

D. Profit

Answer

489.3k+ views

Hint: First of all, we will check the given options and then try to recollect the meaning and definition of each of them. Then, we will define the term Overhead Expenses and move to its details. We will discuss a little bit more on the Overhead Expenses by solving an example problem.

Complete step by step solution:

By definition, Overhead is the additional cost which is added to the cost price of an item. Overhead expenses are all costs on the income statement except for direct labor, direct materials and direct expenses.

Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labors, travel expenditures, and utilities.

Additional information:

For Example:

A shopkeeper buys a scooty from a wholesaler.

He buys a scooty for $40,000$ rupees.

Now, he spends $4,000$ rupees on its transportation.

And then, he spends $1,000$ rupees for its maintenance.

Total cost of scooty $=$ Cost Price $+$ Transportation Charge $+$ Maintenance Charge.

Total cost of scooty $=40,000+4,000+1,000$$=45,000$.

Additional charges paid by the shopkeeper other than the cost price are known as overhead expenses.

Let’s understand more about overhead expenses.

First let’s recall the terms: cost price, selling price, profit and loss.

Cost price is the original price of the item.

Selling price is the price at which the product is sold.

If the selling price of a product is more than the cost price (Selling Price $>$ Cost Price), then profit and profit percentage are calculated as given below.

Profit $=$ Selling Price $-$ Cost Price.

$\text{Profit }\%=\dfrac{\text{Profit}}{\text{Cost price}}\times 100$.

If the cost price of a product is more than the selling price (Cost price $>$ Selling price), then loss and loss percentage are calculated as given below.

Loss $=$ Cost Price $-$Selling Price.

$\text{Loss}\%=\dfrac{\text{Loss}}{\text{Cost price}}\times 100.$

Now, let’s understand overhead expenses.

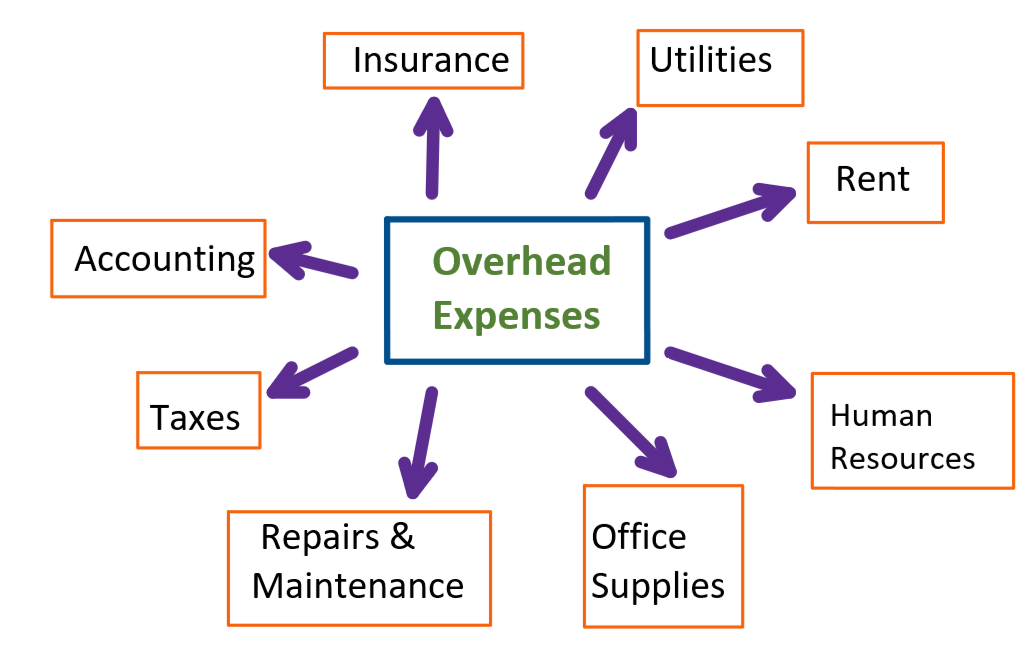

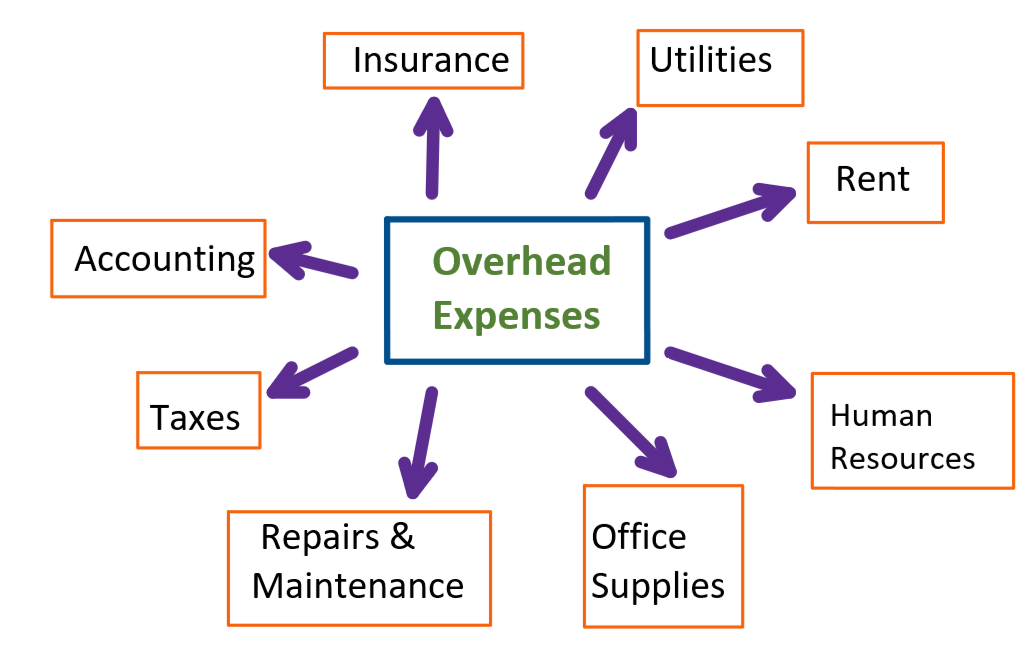

Overhead expenses are expenses or charges other than the original price of an item. Some of the overhead expenses are given below.

In the above problem assume that the shopkeeper sells the sooty to another person called Ram for $40,000$, but the total cost of the scooty is sum of cost price of scooty and overhead expenses then

$\begin{align}

& \text{Total Cost}=40,000+4000+1000 \\

& =45,000

\end{align}$

Here the Total Cost Price is more than Selling price of scooty. Hence the shopkeeper faces a loss of $45,000-40,000=5,000$, hence the loss percentage is

$\begin{align}

& \text{Loss}=\dfrac{\text{Loss}}{\text{Total Cost Price}}\times 100 \\

& =\dfrac{5000}{45000}\times 100 \\

& =11.11\%

\end{align}$

So here the shopkeeper gets a loss of $5000$ rupees with a loss percentage of $11.11\%$

Note: Without considering the overhead expenses there are no proper results for loss and profit. Overhead expenses will play a key role in the business, every seller considers these overhead expenses and according to these expenses they will fix the selling price of an object.

Complete step by step solution:

By definition, Overhead is the additional cost which is added to the cost price of an item. Overhead expenses are all costs on the income statement except for direct labor, direct materials and direct expenses.

Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labors, travel expenditures, and utilities.

Additional information:

For Example:

A shopkeeper buys a scooty from a wholesaler.

He buys a scooty for $40,000$ rupees.

Now, he spends $4,000$ rupees on its transportation.

And then, he spends $1,000$ rupees for its maintenance.

Total cost of scooty $=$ Cost Price $+$ Transportation Charge $+$ Maintenance Charge.

Total cost of scooty $=40,000+4,000+1,000$$=45,000$.

Additional charges paid by the shopkeeper other than the cost price are known as overhead expenses.

Let’s understand more about overhead expenses.

First let’s recall the terms: cost price, selling price, profit and loss.

Cost price is the original price of the item.

Selling price is the price at which the product is sold.

If the selling price of a product is more than the cost price (Selling Price $>$ Cost Price), then profit and profit percentage are calculated as given below.

Profit $=$ Selling Price $-$ Cost Price.

$\text{Profit }\%=\dfrac{\text{Profit}}{\text{Cost price}}\times 100$.

If the cost price of a product is more than the selling price (Cost price $>$ Selling price), then loss and loss percentage are calculated as given below.

Loss $=$ Cost Price $-$Selling Price.

$\text{Loss}\%=\dfrac{\text{Loss}}{\text{Cost price}}\times 100.$

Now, let’s understand overhead expenses.

Overhead expenses are expenses or charges other than the original price of an item. Some of the overhead expenses are given below.

In the above problem assume that the shopkeeper sells the sooty to another person called Ram for $40,000$, but the total cost of the scooty is sum of cost price of scooty and overhead expenses then

$\begin{align}

& \text{Total Cost}=40,000+4000+1000 \\

& =45,000

\end{align}$

Here the Total Cost Price is more than Selling price of scooty. Hence the shopkeeper faces a loss of $45,000-40,000=5,000$, hence the loss percentage is

$\begin{align}

& \text{Loss}=\dfrac{\text{Loss}}{\text{Total Cost Price}}\times 100 \\

& =\dfrac{5000}{45000}\times 100 \\

& =11.11\%

\end{align}$

So here the shopkeeper gets a loss of $5000$ rupees with a loss percentage of $11.11\%$

Note: Without considering the overhead expenses there are no proper results for loss and profit. Overhead expenses will play a key role in the business, every seller considers these overhead expenses and according to these expenses they will fix the selling price of an object.

Recently Updated Pages

Master Class 8 Social Science: Engaging Questions & Answers for Success

Master Class 8 English: Engaging Questions & Answers for Success

Class 8 Question and Answer - Your Ultimate Solutions Guide

Master Class 8 Maths: Engaging Questions & Answers for Success

Master Class 8 Science: Engaging Questions & Answers for Success

Master Class 9 General Knowledge: Engaging Questions & Answers for Success

Trending doubts

What is BLO What is the full form of BLO class 8 social science CBSE

Citizens of India can vote at the age of A 18 years class 8 social science CBSE

Full form of STD, ISD and PCO

Advantages and disadvantages of science

Right to vote is a AFundamental Right BFundamental class 8 social science CBSE

What are the 12 elements of nature class 8 chemistry CBSE