Audit Scams: An Overview

Auditing scandals occur when trusted executives of corporations or governments purposefully manipulate financial data and conceal financial wrongdoings. These offences usually involve complex methods of wasting or squandering money, inflating earnings, understating expenses, misrepresenting the value of company assets, or concealing the existence of liabilities (these can be detected either manually or by means of deep learning). By engaging a worker, an account, or the firm itself, it deceives shareholders and investors.

Audit Scams

Auditing Frauds: What is it Exactly?

Auditing fraud is the intentional manipulation of financial records by a firm or government. Since many financial elements are based on educated estimates, defining fraudulent behaviour in the context of Auditing can be difficult. For example, a company may decide to produce an estimate that is later revised. It is not considered fraudulent behaviour if the corporation generated the estimate in good faith by using relevant data at the time of the estimation.

Auditing fraud occurs when deliberate misstatements are made, such as when a company overstates its assets in order to appear more financially secure. Another example is when a company inflates its revenues to appear more profitable than it is. A fraud audit is a comprehensive examination of a company's financial records with the purpose of detecting instances of fraud. This procedure is more thorough than a conventional audit since certain frauds involve such little sums of money and other assets that they may not meet the usual materiality threshold.

The auditor's responsibility is to gather evidence of fraud, which may lead to the auditor testifying as an expert witness in subsequent legal proceedings. A fraud audit is a consultation service rather than a specific type of audit because the outcome does not include giving an opinion on a client's financial records.

Possible Reasons of Auditing Fraud Cases

Employees' lack of awareness of conventional auditing practices is caused by fraud and error. This happens due to ignorance. The following are few other reasons for auditing fraud:

Employees' improper account classification during the reconciliation of subsidiary ledgers with controlling accounts.

Auditing personnel pay insufficient attention to detail.

An aim to conceal the consequences of any shortages or defalcations.

Management inclination to allow prejudice or bias to influence how transactions are viewed or presented in financial statements.

To avoid paying taxes.

An individual's purposeful actions; to appear or depress the image.

Use the error to your advantage.

Case Study: Enron Corporation

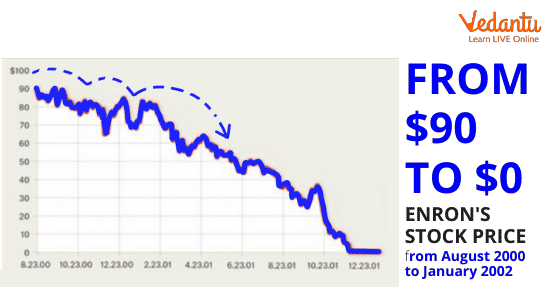

Enron Corporation, an American energy company, and Arthur Andersen, a former Big Five Auditing firm, were both implicated in one of the most well-known and highly documented auditing scandals of the twenty-first century.

Enron disguised billions of dollars in debt by exploiting auditing flaws. Despite being aware of the inaccuracy, Enron's auditors from Arthur Andersen offered unqualified views on the company's financial statements. As a result, both Arthur Andersen and Enron declared bankruptcy.

The Sarbanes-Oxley Act and additional harsher punishments, such as stricter auditing regulations, were enacted. The bill tightened penalties for fabricating financial records, deleting them during government investigations, and lying to shareholders.

Enron Corporation: Audit Scam

Conclusion

Fraud erodes the trust required for a market economy to function effectively. You are unlikely to invest in or give your money to a company whose financial statements you do not trust. Accounting scams hurt not only shareholders and employees but also local and global economies, investors, the accounting profession, and others. Accounting crimes must be avoided, quickly recognised, and successfully prosecuted in order to reduce the damage they bring to organisations and people's money.

FAQs on Audit Scams

1. What do we understand by Internal Control in terms of auditing fraud cases?

Any corporation's financial and operational policies and procedures must have internal controls. All activities taken by the organisation with the goal of functioning as internal controls are regarded as:

Defending its resources against waste, fraud, and inefficiency;

Assuring the accuracy and dependability of financial and operational data; ensuring conformity to the organisation's regulations;

Evaluating the performance of all organisational units' internal controls is just a component of excellent company governance.

2. What does internal audit mean? Explain.

Many large corporations employ internal auditing systems as an integral component of internal control. They have a separate auditing division. The focus and aim of this department vary greatly amongst organisations. Internal auditing is the inspection of a company's various activities and records by individuals hired particularly for the task. This review could be ongoing or only done on a regular basis. Internal audit is an important component of internal control. It is critical to understand that internal control refers to a whole control system, not just an internal audit or check.

3. What are the possible causes of audit scams?

A weak internal control can help a fraudster. Fraud is a social phenomenon, not an accounting problem. When all forms of economic crime are removed, there are only three criminal ways to take money from a victim: by force, stealth, or deception. Invisible financial transactions are ideal for concealing fraud. When a company's management system fails to give accurate, timely, thoroughly detailed, and pertinent results, in such a case, a warning sign of fraud, such as persistent bank account theft, may be hidden. The absence of a distinct audit department within the organisation is another indicator of inadequate internal control.