An Introduction to the Basel Norms

Basel norms, also known as Basel accords, are the international banking regulations issued by the Basel Committee. The Basel Committee was established in 1974. This Committee set standards regarding various banking supervisory matters. The main aim of these standards is to ensure the coordination of banking regulations worldwide. Read ahead to know about the three Basel norms and how they affect Indian economy.

An Introduction to Basel Norms

Basel Norms I

Basel norms are also referred to as banking supervision accords. These are simple standards aimed at increasing the capital ratios of various banks. Basel norms also provided a benchmark for analytical comparative assessment.

Why Basel Norms?

Banks around the world lend to different types of borrowers having different creditworthiness. They lend the deposits of the public and money raised from the market. This exposes the banks to a variety of risks of default. As a result, banks have to keep a certain percentage of capital as security in case of risk of non-recovery. The Basel Committee has created various norms to tackle this risk.

Basel Norms Types

The Basel Committee has issued the following sets of regulations.

1. Basel I: Basel I was introduced in 1988. This Basel norm focused on credit risk. Credit risk arises when a borrower fails to repay a loan or meet contractual obligations. This norm defined the capital and structure of risk weights for banks. The minimum capital requirement was set as 8% of risk-weighted assets. Risk-weighted assets mean a bank's assets are weighted according to risk.

2. Basel II: Basel II guidelines were issued in 2004. These norms were refined versions of Basel-I norms. These norms were based on the following three parameters.

Banks should retain a minimum capital adequacy requirement of 8% of risk assets.

Banks were advised to develop and use better risk management techniques.

Banks must disclose their capital adequacy requirement and risk exposure to the central bank.

Basel II

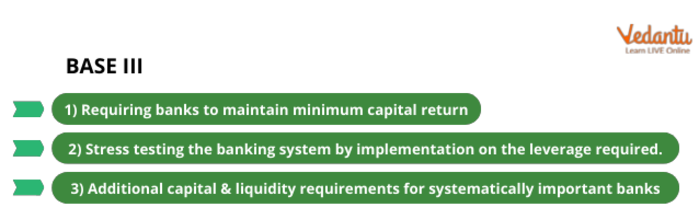

3. Basel III: Basel III guidelines were issued in 2010. These norms were introduced in response to the financial crisis of 2008. A need was felt to strengthen the banking system across the globe. It was also felt that the quantity and quality of capital under Basel II were considered insufficient.

Basel Regulations

The following are some regulations followed by banks regarding Basel norms:

Increasing capital requirements ensures that banks are strong enough to combat losses.

Improving the quality of bank regulatory capital in the form of Common Equity Tier 1 capital.

Specifying a minimum leverage ratio requirement to curb excess leverage in the banking system.

Introducing capital buffers that are maintained in good times and can be used in times of crisis.

The Basel Committee also introduced an international framework for mitigating excessive liquidity risk through the Liquidity Coverage Ratio.

Basel 3 Guidelines

Basel 3 guidelines promote a strong banking system by focusing on four important banking parameters.

Capital - The capital adequacy ratio should be maintained at 12.9%. The minimum tier 1 capital ratio should be 10.5%, and the tier 2 capital ratio should be 2% of risk-weighted assets. Banks are also required to maintain a capital conservation buffer of 2.5%. Counter-cyclical buffers should also be maintained at 0-2.5%.

Leverage - The leverage rate should be at least 3%. The leverage ratio is a bank's tier 1 capital to average total consolidated assets.

Funding And Liquidity - Basel 3 created two liquidity ratios :

i) Liquidity coverage ratio will require banks to hold a buffer of high-quality liquid assets to deal with the cash outflows. The goal is to ensure banks have enough funds.

ii) Net stable funds rate requires banks to maintain a stable funding profile for their off-balance sheet assets and activities. The minimum net stable fund rate requirement is 100%.

Basel 3 Guidelines

India on Basel Norms

The deadline for implementing Basel-III norms was March 2019, but it was pushed to March 2020.

Due to the pandemic, the Reserve Bank of India postponed the implementation of Basel norms for another 6 months.

This resulted in a lower capital burden on banks regarding provisioning requirements.

- This extension would have an impact on how RBI and Indian banks are perceived by global players.

Conclusion

Basel norms are an attempt to harmonise banking regulations around the world. The goal is to strengthen the international banking system and improve the quality of banking worldwide. These norms focus on the risks to banks and the whole financial system. This will allow the banks to grab better financial opportunities and improve their profits.

FAQs on Understanding Basel Norms: Banking Regulations Explained

1. What are the Basel Norms in the context of the banking system?

The Basel Norms are a set of international banking regulations issued by the Basel Committee on Bank Supervision (BCBS). Their primary purpose is to ensure that financial institutions have enough capital on account to meet obligations and absorb unexpected losses. They establish a global standard to strengthen the regulation, supervision, and risk management of banks worldwide, thereby promoting financial stability.

2. What are the three main pillars of the Basel Accords?

The Basel Accords, particularly since Basel II, are structured around three fundamental pillars designed to reinforce the banking system:

- Pillar 1: Minimum Capital Requirements: This pillar mandates that banks must maintain a minimum level of capital, calculated as a percentage of their risk-weighted assets. It covers different types of risks, primarily credit risk, market risk, and operational risk.

- Pillar 2: Supervisory Review: This pillar requires banks to have a thorough internal process to assess their overall capital adequacy in relation to their risk profile. It also gives supervisors the power to require banks to hold capital in excess of the prescribed minimum.

- Pillar 3: Market Discipline: This pillar aims to increase transparency through enhanced disclosure requirements. It compels banks to disclose details on their risk exposures, capital adequacy, and risk management processes, allowing market forces to act as a disciplining factor.

3. What is the importance of the Capital Adequacy Ratio (CAR) under Basel Norms?

The Capital Adequacy Ratio (CAR), also known as Capital to Risk (Weighted) Assets Ratio (CRAR), is a critical metric under the Basel Norms. Its importance lies in measuring a bank's financial health and stability. It represents the ratio of a bank's capital to its risk-weighted assets. A higher CAR indicates that a bank has a stronger capital base and is better positioned to absorb potential losses, thus protecting depositors and promoting stability in the financial system.

4. How have the Basel Norms evolved from Basel I to Basel III?

The Basel Norms have evolved significantly to address the changing dynamics of the global financial system:

- Basel I (1988): This was the initial accord and focused almost exclusively on credit risk. It introduced the concept of a minimum capital requirement, setting the CAR at 8%.

- Basel II (2004): This accord introduced a more sophisticated framework by incorporating operational risk and market risk alongside credit risk. It established the three-pillar structure (Minimum Capital Requirements, Supervisory Review, and Market Discipline).

- Basel III (2010): Developed in response to the 2008 global financial crisis, Basel III significantly enhanced the framework. It mandated higher and better-quality capital, introduced a capital conservation buffer, and established new standards for liquidity through the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to address short-term and long-term funding risks.

5. How is 'operational risk' defined under the Basel framework?

Under the Basel framework, operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events. This definition includes legal risk but specifically excludes strategic and reputational risk. It covers a wide range of potential failures, such as internal fraud, system failures, human errors, and disruptions from natural disasters.

6. How do the Basel III norms reflect a macroprudential approach to regulation?

Basel III norms embody a macroprudential approach by focusing on the stability of the financial system as a whole, rather than just the safety of individual banks. This is evident through measures like the Counter-Cyclical Capital Buffer (CCyB), which requires banks to build up extra capital during periods of rapid credit growth to absorb losses during a downturn. Additionally, the framework for identifying and imposing higher capital requirements on Systemically Important Financial Institutions (SIFIs) is a key macroprudential tool designed to reduce the risk they pose to the entire system.

7. What are the primary challenges for Indian banks in implementing Basel III norms?

Indian banks face several significant challenges in implementing the Basel III norms:

- High Capital Requirement: Meeting the higher minimum capital requirements necessitates raising substantial amounts of equity capital, which can be challenging, especially for public sector banks.

- Impact on Profitability: The need to set aside more capital as provisions can strain a bank's profitability and reduce its capacity for lending, potentially slowing down credit growth.

- Risk Management Systems: Complying with the advanced approaches for risk measurement requires significant investment in technology, data management, and skilled personnel.

- Balancing Growth and Compliance: Banks must strike a difficult balance between adhering to strict international regulatory standards and meeting the credit demands of a growing economy.

8. What does the term 'Basel IV' signify for the banking industry?

'Basel IV' is an informal term used to describe the final set of reforms to the Basel III framework, which were finalised by the BCBS in 2017. It is not a new, separate accord but a completion of Basel III. The main objective of these reforms is to reduce excessive variability in how banks calculate their Risk-Weighted Assets (RWAs). By constraining the use of banks' internal models for calculating capital requirements, Basel IV aims to improve the comparability and transparency of bank capital ratios across the globe.