Introduction to Curve Finance

A curve finance is a decentralised exchange that permits quick, productive, and low-contact stable coin trades, demonstrating that decentralised unfamiliar cash substitute. It helps the investors to avoid dealing in volatile crypto assets and provides the reasons for investing in curve finance. Similar to Uniswap (a cryptocurrency exchange), tokens of Curve finance can also be swapped when there is liquidity. This liquidity amount can be used as a part of the ecosystem by other DeFi applications.

Bend is a decentralised substitute for trading digital money resources. The vital qualification between them is that on Uni swap, you can trade any ERC-20 token (as extended as there's liquidity), while Bend is uncommonly for trading stable coins on Ethereum.

Bend by and by helps to trade for the accompanying stable coins: DAI, USDT, USDC, GUSD, TUSD, BUSD, UST, EURS, PAX, USD, USDN, USDP, RSV, LINKED. You can trade ETH, Connection, and a modest bunch of tokenized BTC properties like WBC and robotics.

Features of Curve

Insignificant Transitory Misfortunes: These are misfortunes caused mid-exchange. Most contributors can't execute orders right away, they initially buy a request, convert the resource to be exchanged into Ethereum, store it at that point, convert it again into the new resource or coin that is required. On the off chance that the expense of the new resource goes up between the hour of request and conveyance, the supplier endures the worst part of the misfortune to outfit clients with the expense.

Consolidations: One of the innumerable benefits of decentralised exchange structures is the total of different assortments of digital currencies to boost profit for the brokers. Even with expressed total comes the need to consistently watch the substitute charges between the connected property to avoid taking large misfortunes.

Pools: The transporter uses pools for liquidity, beneficial to the organisations with rates of pay gotten from clients' support but are legitimately now not responsible for any misfortunes brought about through the clients.

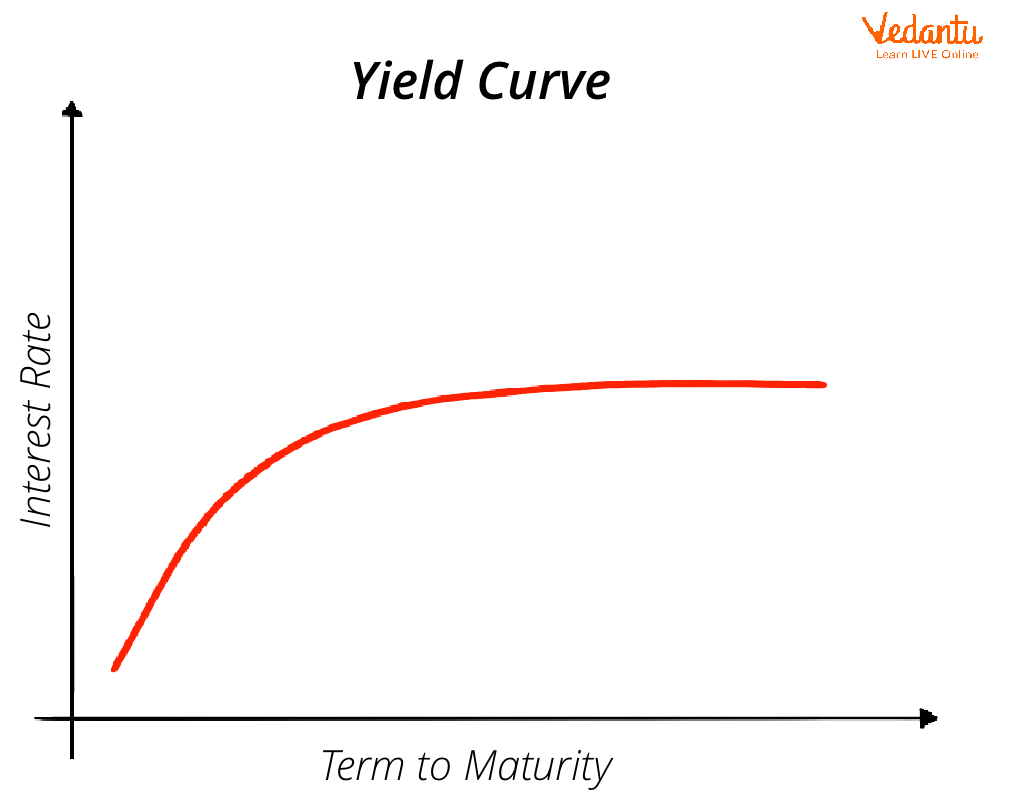

Yield Curve

The Yield Curve is a graphical outline of the hobby costs on obligation for a difference of developments. The sketch shows a security yield on the upward pivot and the chance to develop throughout the level hub. The bend can likewise take uncommon shapes at outstanding elements in the financial cycle, but it is mostly up slanting.

Yield Curve

A steady profit investigator can likewise utilise the yield bend as a real money-related pointer, especially when it moves to a modified shape, which marks a monetary slump, as long haul returns decline than flashing returns.

Type of Yield Curve

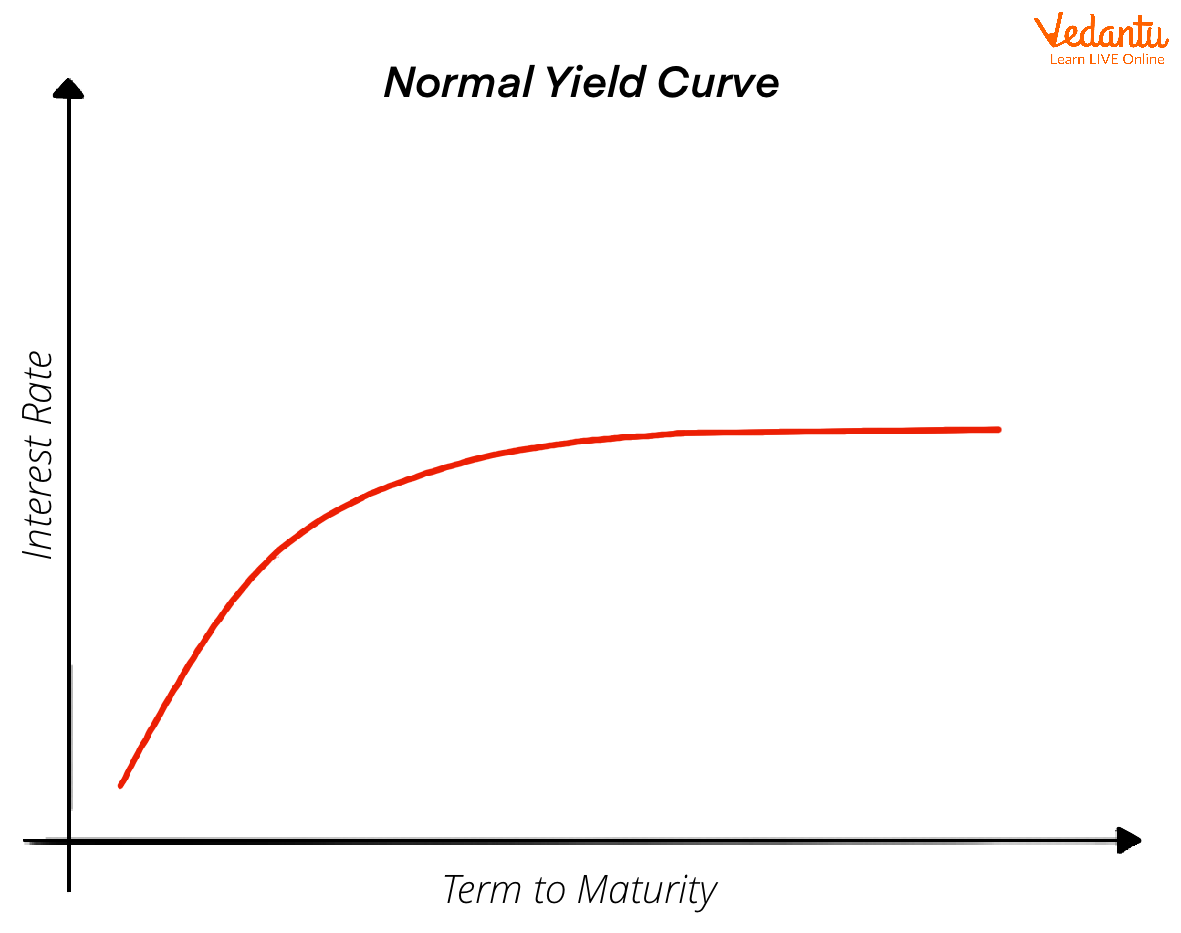

1. Normal Curve

This is the most successive structure for the bend and, consequently, is alluded to as the regular bend. The customary yield bend shows more noteworthy distraction costs for 30-year securities as antagonistic to 10-year securities. Assuming that you guess about it naturally, if you are loaning your money for a more extended length of time, you expect to procure a more prominent pay for that.

Normal Yield Curve

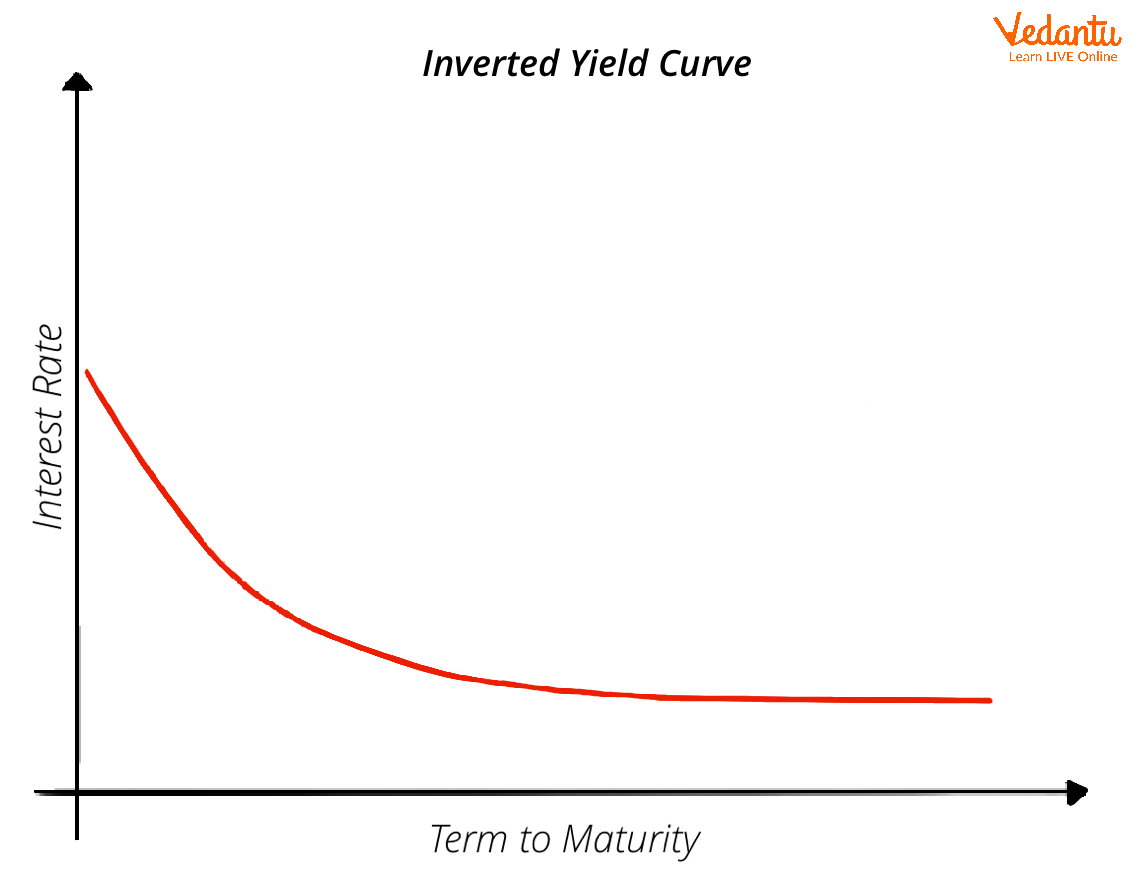

2. Inverted Yield Curve

An inverted curve appears when long haul yields fall underneath brief yields. A reversed yield bend happens because of the comprehension of long haul purchasers that leisure activity expenses will decrease from here on out. This can appear for a wide assortment of reasons, but one of the significant thought processes is the assumption of a decrease in expansion. As obvious through the blue bend in the diagram above, it occurred in 2000 however long the website air pocket would last.

Inverted Yield Curve

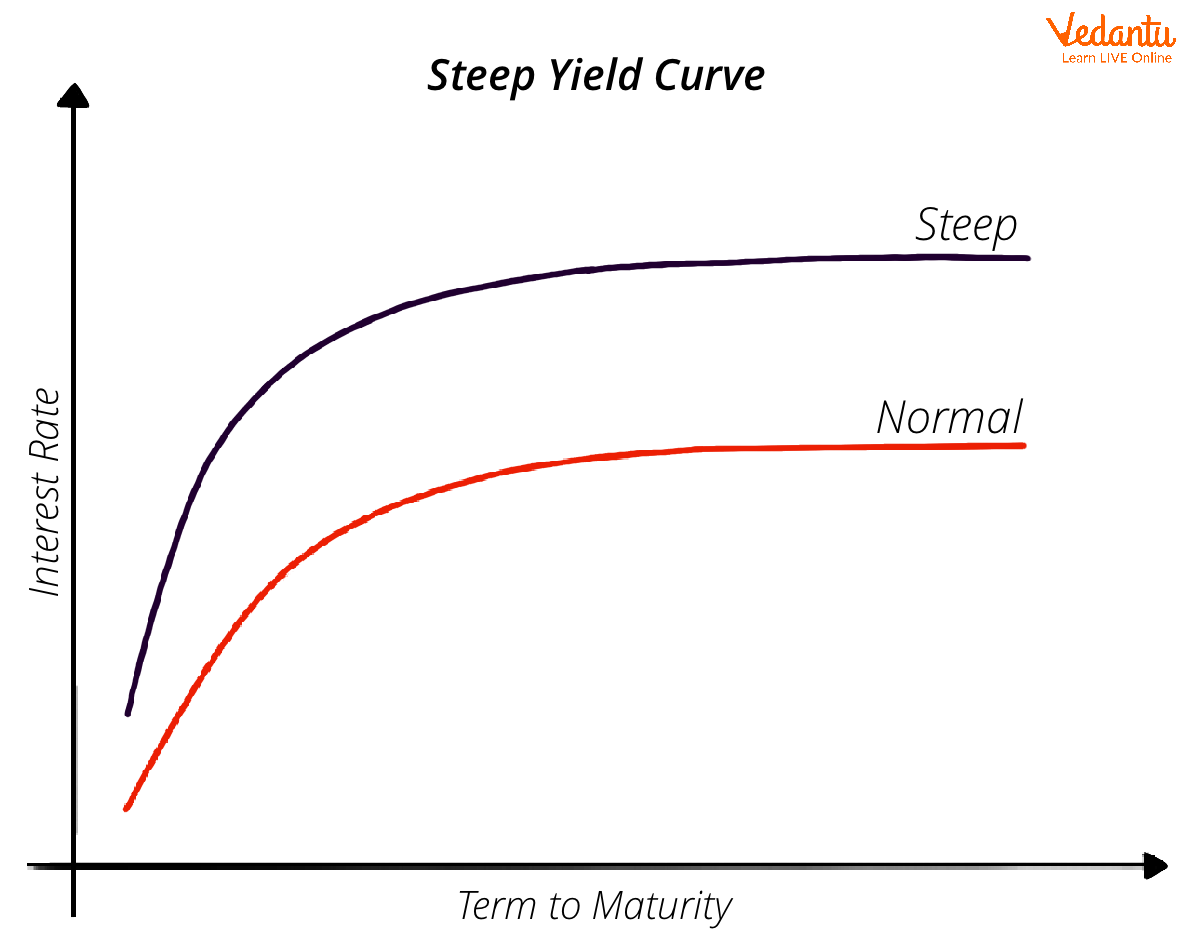

3. Steep Yield Curve

A steep curve shows that drawn-out yields are ascending at a speedier cost than brief yields. Steep yield bends have generally shown the start of an expansionary financial period. Both the normal and steep bends depend absolutely on the indistinguishable regular economic situations. The exclusive diffrentiation is that a more extreme bend mirrors a huge qualification among brief and long haul brings assumptions back. A steep yield bend cautions that the diversion charges are expected to be developed in the future.

Steep Yield Curve

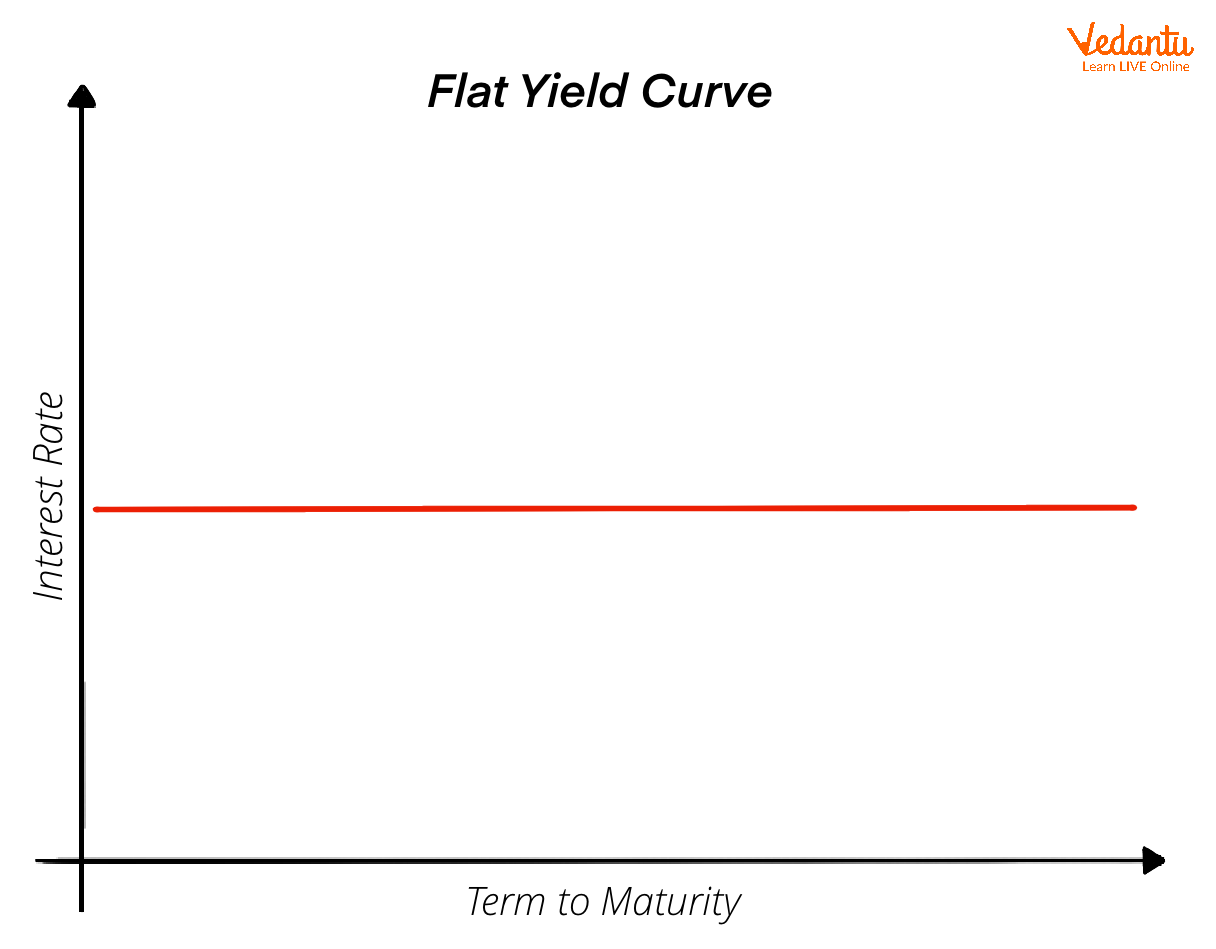

4. Flat Yield Curve

A flat curve happens when all developments have tantamount yields. This capacity that the yield of 10-year security is if believes it or not equivalent to that of 30-year security. The wrecking of the yield bend typically happens when there is a change between the standard yield bend and the modified yield bend, one in which there is no huge differentiation between yields on non-extremely durable and long haul obligations. Since the drawn-out yield is declining than ordinary, a level yield curve points to a stoppage in the financial framework and a decrease in movement rates.

Flat Yield Curve

Yield Curve Theories

Particular hypotheses endeavour to give for the exceptional states of the yield bend, to be specific, the unadulterated assumptions hypothesis, the liquidity top class hypothesis, the market division hypothesis, and the ideal environment hypothesis.

Unadulterated Assumptions Hypothesis

Unadulterated assumptions (likewise alluded to as assumptions idea or unprejudiced assumptions hypothesis) argue that the drawn-out distraction charges range from non-super durable diversion costs because of the real financial market individuals have remarkable assumptions connected with hobby statements and expansion in the short-run and long-run.

Liquidity Want Hypothesis

The liquidity decision idea depends absolutely on the reason that all purchasers choose a brief skyline because the reality long haul skyline contains a more prominent action charge risk. It proposes that brokers should be repaid with a more noteworthy profit from long-haul ventures. Indeed, even albeit the liquidity want idea makes sense of the standard yield.

Market-Division Hypothesis

The market-division idea helps the possibility that different interest and outfit determinants exist for impermanent and long haul protections and their association in great business sectors conclude the type of the yield bend.

Favoured Environment Hypothesis

The ideal territory guideline is practically identical to the showcase division rule because it proposes that unmistakable market individuals have phenomenal eagerness and potential which directs their incline toward developments.

Bonding Curve

A bond as the line is straight (see different structure depictions beneath). You can "purchase up" a bend, and that implies you mint (purchase) new tokens, and because of the reality, this will expand the cutting edge symbolic stockpile, the energise strikes. You can furthermore "sell down" a bend, and that intends that as you are consuming (selling) tokens, you are using the rate somewhere near utilising diminishing the inventory.

Bonding Curve

Summary

The yield twist proposes the association between the advancements of protections and their regards improvement. In the standard case, passing protections yield significantly not exactly long stretch protections, and the yield twist is up inclining. Monetary patrons should be content material with declined returns when they make adventures for the present moment.

FAQs on Curve Finance

1. What sorts of assessed yield bends are reachable for the UK?

We produce three sorts of assessed yield bends for the UK consistently: A set principally founded on yields on UK specialists securities (likewise recognized as gilts). This comprises ostensible and real yield bends and the suggested expansion period shape for the UK. Yield bends plot leisure activity charges of obligations of equivalent investment funds and explicit developments. While general bends element to monetary extension, descending inclining (altered) bends variable to financial recession. I posted yield bend statements on the Depository's web webpage each trading day.

2. What Is the U.S. Safe Yield Bend?

The U.S. Vault yield twist suggests a line chart that depicts the yields of passing Depository portions as opposed to the yields of long stretch Depository notes and protections. The chart shows the association between the relaxation movement quotes and the improvements of U.S. Safe fixed-pay assurances. The Depository yield twist (moreover insinuated as the period condition of relaxation action rates) suggests yields at consistent turns of events, similar to one, two, three, and a half years and one, two, three, five, seven, 10, 20, and 30 years. Since it trades Depository portions and protections bit on the assistant market, yields on the notes, bills, and protections waver. These hills are overall for the mid-term improvements, a half year to two years. Similar yields across all turns of events.

3. How does the Powerful Yield twist device work?

Our Dynamic Yield Bend device suggests the costs for 90 days, two years, 5 years, 7 years, 10 years, 20 years, and 30 years. The vertical centre point of a yield twist frame proposes the yield, while the level turn exhibits the improvement of the protections (regularly different into months to get a fit scaling on the chart). Analysis of the yield twist helps vendors with finishing up how security markets are found and in what course they are likely headed.

4. What is the perceptive force of the security yield twist?

Security yield twist holds perceptive powers. The security market is an incredible sign of future monetary redirection and future degrees of development, all of which immediately influence the charge of the whole thing from stocks and certified property to family things. In this article, we will examine non-very strong versus Long-stretch leisure activity rates. A security yield is the whole return got through a monetary benefactor on security. The return comes from the bond's coupon portions. Monetary patrons can use the straightforward coupon regarding resolving the security yield. However, this approach disregards any changes in security utilizations or the time cost of money.