What is Elasticity of Demand?

Demand that is relatively elastic suggests that a change in the price of a good or service will have an effect on the quantity required of that good or service. A product or service is typically said to have significant price elasticity when there are several replacements available.

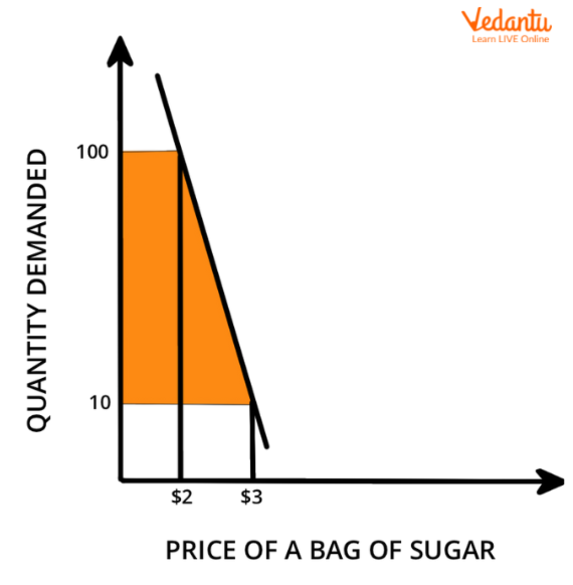

Example: You might see salt and a variety of salt alternatives when you browse the aisle at the grocery store. Would you be willing to pay an extra 2 for a bag of salt if there were salt replacements instead if the price of salt increased by 2 per bag tomorrow? Most people would switch from preferring salt to one that contains sugar substitutes, which would lower their demand for pure salt. Since most economists concur, salt is viewed as a good with a high degree of elasticity.

Relatively Elastic demand

Relatively Elastic demand

Types of Elasticity of Demand

Elasticity of demand is classified into three types based on the many elements that influence the quantity desired for a product:

Price Elasticity of Demand (PED),

Income Elasticity of Demand (IED) (YED), and

Cross Elasticity of Demand (XED)

1)Price Elasticity of Demand (PED)

The Price Elasticity of Demand (PED) is the quantity requested for a product is affected by any change in the price of a commodity, whether it be a drop or an increase. For example, as the price of ceiling fans rises, the quantity requested decreases.

The Price Elasticity of Demand is a measure of the responsiveness of quantity sought when prices vary (PED).

The mathematical formula for calculating Price Elasticity of Demand is as follows:

PED = %Change in Quantity Demanded % / Change in Price.

The formula's output determines the magnitude of the influence of a price adjustment on the amount required for a commodity.

2). Income Elasticity of Demand (YED)

The Income Elasticity of Demand (YED) is the Consumer income levels have a significant impact on the amount requested for a product. This may be seen in the contrast between commodities sold in rural marketplaces and those sold in urban markets.

The Income Elasticity of Demand, commonly known as YED, refers to the sensitivity of the quantity requested for a certain commodity to changes in real income (the income generated by a person after accounting for inflation) of the consumers who buy this good, while all other variables remain constant.

The formula for calculating the Income Elasticity of Demand is as follows:

YED = % Change in Quantity Demanded% / Change in Income

The formula's output may be used to assess if a product is a need or a luxury item.

3. Cross Elasticity of Demand (XED)

In the Cross Elasticity of Demand (XED), in an oligopolistic market, numerous companies compete. Thus, the amount desired for a commodity is affected not only by its own price, but also by the prices of other items.

Cross Elasticity of Demand (XED) is an economic term that assesses the sensitivity of quantity requested of one good (X) when the price of another item (Y) changes, and is also known as Cross-Price Elasticity of Demand.

The formula for calculating the Cross Elasticity of Demand is as follows:

XED = (% Change in Quantity Demanded for one good (X)%) / (Change in Price of another Good (Y))

The result for a substitute good would always be positive since anytime the price of an item rises, so does the demand for its alternative. In the case of a complementary good, however, the outcome will be negative.

What Makes a Product Elastic?

A product is considered elastic when even a small change in its price causes a significant change in how much people buy. This often happens when there are plenty of substitutes available, meaning buyers can easily switch to a similar product if the price rises. Products that are not essential or are considered luxury items tend to be more elastic because people can reduce or delay their purchases when prices increase. Additionally, if a product takes up a large portion of a person’s budget, they are more likely to react to price changes, making it more elastic.

Factors Affecting Elasticity of Demand

The more substitutes available, the easier it is for people to switch, making demand more elastic.

Necessities are inelastic because people need them, while luxuries are elastic as they can be skipped.

Expensive items that take up a large part of income are more elastic, while cheaper items are inelastic.

Demand is more elastic in the long run because people have time to find alternatives or adjust.

Products that are addictive, like cigarettes or coffee, have inelastic demand as people keep buying them despite price changes.

Importance of Elasticity of Demand

Businesses use elasticity to decide pricing strategies. If demand is inelastic, they can raise prices to boost revenue without losing many customers.

Governments focus on taxing inelastic goods (like fuel or tobacco) because people continue buying them even with higher taxes.

Elasticity helps businesses understand if lowering prices will attract more buyers and increase overall revenue.

Policymakers use elasticity to predict how price changes (e.g., in essential goods) will affect consumer spending and the economy.

Countries prioritize exporting goods with inelastic demand to ensure stable trade revenues even during price fluctuations.

Relatively Elastic Demand Example

The majority of necessities tend to be very inelastic.

Example : A youtube business with 50,000 subscribers offers a service for 100 a year. The corporation increases the subscription service's cost by 30%, from 100 per year to $130. The company now has 52,000 users, a 4 % increase after the price rise. The service is comparatively inelastic because the price increased by 30% while the demand increased by only 4%.

Conclusion

Economists attempt to quantify the degree to which demand is sensitive to changes in price for a particular good using the concept of price elasticity of demand. This assessment can be helpful in predicting consumer behaviour as well as big occurrences like an economic recession or recovery. Every day, as customers, we make choices that economists track. We may consume less of a good or none at all if its price rises and we can survive without it, there are many replacements, or both. Despite price hikes, we will continue to demand large amounts of water, medicine, and gasoline as needed.

FAQs on Elasticity of Demand: Types and Applications

1. What is demand elasticity in simple terms?

Demand elasticity refers to how much the quantity demanded of a product changes when its price changes. It measures how sensitive consumers are to price shifts.

- If a small price increase causes a big drop in sales, the demand is called elastic.

- If sales barely change after a price increase, the demand is inelastic.

- Businesses use elasticity to set prices and predict revenue.

2. What is the difference between inelastic and elastic demand?

Elastic demand means that buyers react strongly to price changes, while inelastic demand means buyers hardly react.

- Elastic demand: Even a small price increase leads to a large drop in quantity demanded (e.g., luxury goods, movie tickets).

- Inelastic demand: Even a large price increase causes only a small decrease in quantity demanded (e.g., essential medicines, basic foods).

- Retailers and policymakers use these concepts to forecast sales and make pricing decisions.

3. What are the 5 points of elasticity of demand?

There are five main types or points of elasticity of demand, describing how quantity demanded responds to price changes:

- Perfectly elastic: Any price change causes demand to drop to zero or rise to infinity.

- Elastic: Quantity demanded changes more than the price change (elasticity > 1).

- Unitary elastic: Quantity demanded changes exactly in proportion to the price change (elasticity = 1).

- Inelastic: Quantity demanded changes less than the price change (elasticity < 1).

- Perfectly inelastic: Quantity demanded does not change at all, no matter the price (elasticity = 0).

4. What is the law of elasticity of demand?

The law of elasticity of demand says that the quantity demanded of a product changes at different rates when its price changes.

- If demand is elastic, a small price rise decreases sales a lot.

- If demand is inelastic, sales barely change after a big price increase.

- The law helps businesses understand how much revenue may change with different prices.

5. Why is elasticity of demand important in economics?

Elasticity of demand is vital in economics because it helps predict how changes in price affect consumer buying and company profits.

- It guides pricing strategies for businesses to maximize revenue.

- It influences government policies, like setting taxes or subsidies on certain products.

- It helps analyze the impact of market events on total sales and equilibrium.

6. How do you calculate price elasticity of demand?

Price elasticity of demand measures how much quantity demanded changes when price changes. Calculate it using this formula:

- $\text{Elasticity} = \frac{\%\ \text{Change in Quantity Demanded}}{\%\ \text{Change in Price}}$

- For example, if a 10% price increase causes a 20% drop in sales, elasticity = $\frac{-20}{10} = -2$.

- Results: Elastic (>1), Unitary (=1), Inelastic (<1).

7. What factors affect the elasticity of demand?

Many factors influence whether demand is more or less elastic for a product.

- Availability of substitutes: More substitutes make demand more elastic.

- Necessity vs. luxury: Necessities have inelastic demand; luxuries have elastic demand.

- Income level: Higher income may make demand less sensitive to price.

- Time period: Demand is more elastic over the long term.

8. Can elasticity of demand be negative?

Yes, elasticity of demand is usually expressed as a negative value because price and quantity demanded move in opposite directions.

- When price rises, demand generally falls—that's a negative relationship.

- The formula produces a negative sign, so economists often use the absolute value for simplicity.

- Negative elasticity reflects the normal behavior described by the law of demand.

9. What is an example of a product with elastic demand?

An example of a product with elastic demand is movie tickets. Consumers quickly reduce buying when prices rise.

- Entertainment and luxury goods are usually more price sensitive.

- Many alternatives exist, such as streaming or watching TV at home.

- People can easily delay or avoid non-essential purchases.

10. What happens to total revenue when demand is elastic?

When demand is elastic, increasing the price leads to a drop in total revenue because sales fall sharply.

- In elastic demand, the percentage drop in quantity is greater than the percentage rise in price.

- Lowering the price can actually increase total revenue for elastic products.

- This is key for companies selling goods with high price sensitivity.