Japan’s Lost Decade

Deflation is a situation that occurs when consumer and asset prices reduce over time and purchasing power increases. One can purchase more goods or services tomorrow with the same amount of money he/she has today. This is the picture of inflation, the gradual accretion in prices across the economy.

Japan’s Lost Decade

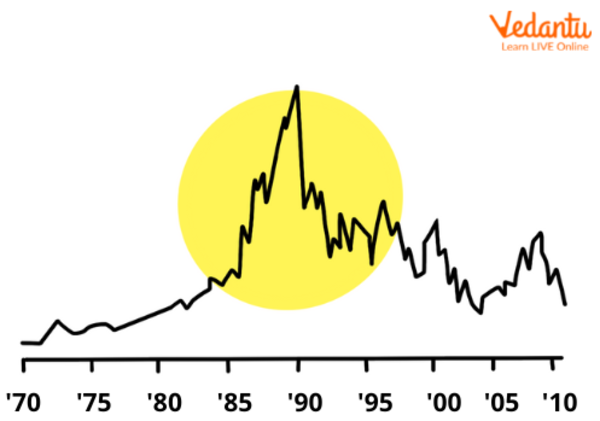

After Japan's asset bubble burst in the early 1990s, the economy slowed, and the inflation rate was brought down gradually. The economy was deflated in the middle of the continuous collapse of major financial institutions in the late 1990s. After that, except for some time when commodity prices rushed, the CPI inflation rate stayed in negative territory for around 15 years.

Bubble Economy Japan

Japan was called the bubble economy of the 1980s as it symbolised an era that merged easy credit with uncontrolled speculation and finally drove Japanese equity and real estate markets to gigantic price levels. In 1992–93 this signalled a deep recession, the seriousness of which delayed many of the earlier reform plans, further weakened Japanese consumer confidence and unavoidably worsened trade tensions. However, Japan’s distributed trade surplus with the world continued to shoot up. Those export surpluses finally produced a fast realisation of the yen against the dollar in the mid-1990s. Irreconcilable to America's assumption, however, this had only slight results on the trade balance. Simultaneously, the well-established Japanese currency allowed Japanese firms and individuals to spend heavily abroad by buying foreign assets at discount prices.

Japanese Asset Price Bubble

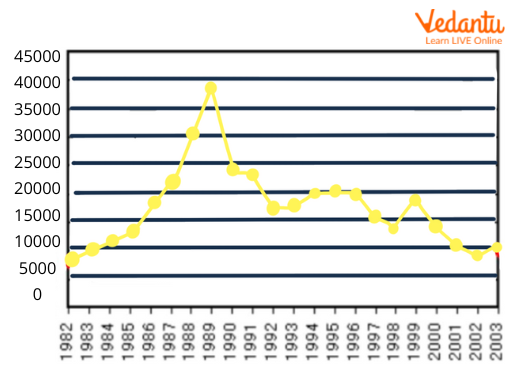

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991; after that, real estate and stock market prices were considerably inflated. In early 1992, this asset price bubble burst and Japan’s economy sluggish. The bubble was distinguished by a rapid increase in asset prices, scorching economic activity, and an unrestrained money supply and credit expansion. More precisely, audaciousness and speculation about asset and stock prices were closely connected with excessive monetary easing policy. Through the formation of economic policies that cherished the marketability of assets, eased the accessibility to credit, and cheered up speculation, the Japanese Government started an elongation and provoked the Japanese asset price bubble.

Japanese Asset Price Bubble

By August 1990, the Nikkei stock index had smashed to half its top by the time of the fifth monetary tightening by the Bank of Japan. By late 1991, other asset prices began to shoot down. Even though asset prices had noticeably collapsed by early 1992, the economy's decline resumed for over a decade. This decline resulted in a huge increase in non-performing assets loans (NPL), causing difficulties for many financial institutions. The Japanese asset price bubble bursting resulted in what many call the Lost Decade. Japan's average nationwide land prices finally increased year-over-year in 2018, with a 0.1% increase over 2017.

Japan Inflation Rate

As per the Ministry of Internal Affairs data, Japan's annual inflation rate was at 2.4% in June 2022, but little changed from May. It was the tenth continued month of consumer price rises, in the middle of surging fuel and food costs following Russia's capturing of Ukraine and a sharply weakening yen. Prices increases further for food (3.7% vs 4.1% in May), fuel, light and water expenses (14.0% vs 14.4%), clothes (1.1% vs 0.9%), housing (0.6% vs 0.5%), furniture (3.9% vs 3.6%), education (0.7% vs 0.8%), and miscellaneous (1.2% vs 1.1%). At the same time, prices continued to fall for both transport (-0.7% vs -0.8%) and medical care (-0.7% vs -0.8%). Core consumer prices were at 2.2% yen in June following a 2.1% rise in May and matching forecasts, remaining above the Bank of Japan’s 2% target for the third month. Every month, consumer prices were firm in June after an uphill revised 0.3% gain.

Economic History of Japan

Japan is one of the enormous and most developed economies in the world. It has a well-educated, industrious workforce, and its large, prosperous population makes it one of the world’s biggest consumer markets. Japan’s economy was the world’s 2nd largest (behind the US) from 1968 until 2010, when it was left behind by China. Japan’s gross domestic product (GDP) in 2016 was estimated to be USD 4.7 trillion, and its population of 126.9 million has the benefit of a high standard of living, with a per capita GDP of below USD 40,000 in 2015.

With its exceptional economic revival from the clinkers of World War II, Japan was one of the 1st Asian countries to jump up the value chain from cheap textiles to advanced manufacturing and services – which account for most of Japan’s GDP and employment. Agriculture accounts for 1% of GDP.

Case Study

The Great Recession of 1920

The 1920s started with a great but short recession that gave way to an extended period of economic expansion. Lavish wealth, depicted in F. Scott Fitzgerald's "The Great Gatsby," became an American centrepiece during the Roaring Twenties. The bubble started when the Fed eased credit requirements and decreased interest rates in the second half of 1921 through 1922, hoping to stimulate borrowing, increase the money supply, and stimulate the economy. It worked, but too soon, consumers and businesses started taking on more debt than ever. By the middle of the decade, there was an added $500 million in circulation compared to five years earlier. The Fed’s easy money policies extended through most of the 1920s, and stock prices rose due to the new money flowing into the economy through the banking system.

Conclusion

In the recent past, low inflation and low-interest rates have been extended worldwide, and many central banks face the common challenge of increasing the inflation rates. Based on this acknowledgment, Japan's experience and challenges form a somewhat long-term frame of reference, as Japan faced low inflation and low-interest rates early and has tried various efforts to overcome this situation. Japan's economy has improved remarkably while the Bank has carried on with powerful monetary easing through "QQE with Yield Curve Control." The positive annual CPI inflation has taken hold, and the economy is no longer in deflation due to a sustained price decline. Annual CPI inflation is in the range of 0.5-1.0 percent.

FAQs on Japan’s Deflation

1. What are the causes of Asset Deflation and the challenges to overcome?

Asset price bubbles accept blame for some of the most destructive recessions.

Asset bubbles are especially destructive for individuals and businesses who invest too late, interpreting shortly before the bubble bursts. In this view, asset price bubbles bear a resemblance to Pyramid scams. The unavoidable fall of asset bubbles destroys investors' net worth and causes exposed businesses to fail, potentially touching off a flow of debt deflation and financial crash that can spread to other parts of the economy, resulting in increased unemployment and lower production that resembles a recession.

2. What do you mean by Helicopter Money? Explain.

The term Helicopter Money was invented by economist Milton Freedman. Re-expand an economy isn't easy, particularly if banks are unwilling or unable to lend. American economist Milton Friedman suggested avoiding a liquidity trap by avoiding financial intermediaries and allotting money directly to individuals to spend. This procedure is known as "helicopter money" because the concept is that a central bank could release money from a helicopter. Helicopter money means to increase a nation's money supply by more spending, tax cuts, or improving the money supply.

Helicopter Money

3. Why is 1990 called the Lost Decade? Explain.

From 1991 to 2001, Japan faced a period of economic weakening and price deflation referred to as "Japan's Lost Decade." While the Japanese economy left behind this period, it achieved this much slower than other industrialised nations. The Japanese economy suffered a credit crunch and a liquidity trap during this period.

A credit crunch is an economic scheme in which banks have tightened lending conditions and, in most cases, do not lend.

A liquidity trap is an economic scheme in which households and investors sit on cash, either in short-term accounts or cash on hand.