An Introduction to Leading Economic Indicators

Leading Economic Indicators are the statistics which help in indicating changes in the economy. Leading Indicators change before the economy shows any change signs. These indicators signal major changes. Thus, they are used by investors for the prediction of changes in the economy and for making relevant decisions. Also, these indicators are used by the central bank for making fiscal and monetary policies for the economy.

What are Leading Economic Indicators?

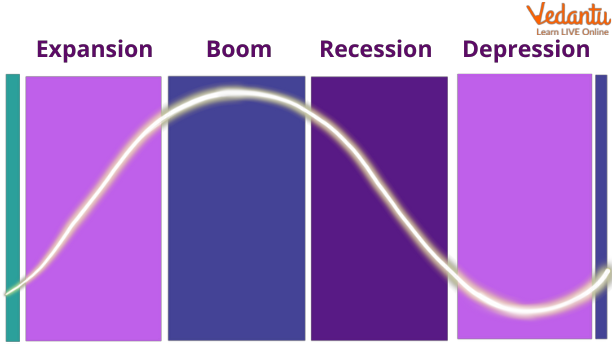

Leading Economic Indicators are defined as a set of statistics related to economic activities which help in forecasting the macroeconomic scenarios of the economy and emerging stages of the business cycle by means of acting variable with economic linkage. It helps in providing early signs of turning points in the business cycles.

Business Cycle

How are Leading Economic Indicators Helpful?

It is very important to know about the state of the economic cycle for macroeconomic policy decision-making. The economy can be in an expansionary phase, or recessionary phase, so countercyclical policies need to be implemented accordingly. To understand the economic stages, various economic variables are used. These are referred to as economic indicators.

Leading indicators help economists to predict the future by forecasting the direction of economic activities, which further helps in making relevant economic policies.

Advantages of Leading Economic Indicators

The following gives the benefits of using leading economic indicators:

Indicators and economic charts help in predicting the future trends of the economy, which further helps in forecasting trends of the economy.

They help in identifying threats and further takes corrective action.

They help in tracking the economic stages and cycles.

With the help of indicators, relevant monetary and fiscal policies as per the need of the hour can be framed.

They help in understanding the economy as a whole, also checks upon the loopholes and tracks the economic performance so that in the future corrective action can be taken.

Dynamic Business Environment

Indicators for Helpful Review: Economic Indicators

Some indicators for helpful review are as follows :

Durable Goods Order Report

It tells when companies will order new big-ticket items. For example- machinery and automobiles. It is not similar to consumer purchases of durable goods, but it is about a business whose purchase depicts business cycles. When a business regains confidence about the future, then it looks forward to purchasing new equipment and trying to replace the old one. This depicts the market nature and stages.

Stock Markets

These are the most predictive indicators of economic conditions. The expected earnings of the firm are depicted in its stock price. When there is a rise in stock price, then it indicates more confidence related to future growth. If there is a fall in stock price, it indicates a decline in the economic condition.

These were the top 2 indicators of a helpful review.

HDI

Human Development Index shows the education, life expectancy, per capita income which helps to rank the countries in the terms of human development. This index gives a detail about the human capability a country is possessing.

Happiness Index

The world happiness report reveals the bright light in the dark time. It is an indicator of global happiness and the elements that influence the quality of life. The components of this index include GDP level, quality of life, and life expectancy.

Stock Market

Case Study

Gross Domestic Product is one of the best indicators for analysing economic conditions. India has become the fifth-largest economy in terms of GDP. It has overtaken the United Kingdom. The Indian economy is worth USD 854.7 billion. The rapid shift in India is driven by its continuous growth over the last 25 years. It is also after the opening up of the Indian Economy post-1990. The upward revision in India’s growth is because of its right policies and its realignment in the geopolitical scenario. The increase in GDP is an economic indicator that the country is moving in the direction of growth because of its investment, infrastructure, policies and alignment in world politics.

Conclusion

Leading Economic Indicators are dynamic in nature which helps to identify the turning points in economic activities. The help of indexes, economic charts, tracking indicators, the human development index (HDI), and growth forecasts make it easy to track economic trends. As the economic indicators help in forecasting the economic stage and trends, they may not be the same as the actual. These leading indicators help in formulating macroeconomic policies by easily identifying threats and opportunities in the dynamic economic environment.

FAQs on Understanding Leading Economic Indicators

1. What are the limitations of the leading economic indicators?

Leading Economic indicators are dynamic in nature, difficult to identify, and their measurement is quite tough. These economic indicators may not be accurate because of their dynamic nature as indicators forecast future economic activities. This may not be true because these are just predictions based on indexes and data sets. Also, more reliance is on the quantitative side, which may lead to ignorance of qualitative data. The validation of lead indicators can be a challenge which may lead to a deviation between the forecasts and the actual.

2. What is focuseconomics?

Focuseconomics is a provider leading in economic analysis and forecasts of around 200 countries and 34 key commodities. It was launched in 1999 and has established a good reputation among its clients. The company focuses on providing valuable insights and a reliable source of information about economic variables and conditions. The information and business intelligence provided by the company are accurate and further help in relevant decision-making. It provides information to industries, businesses, financial institutions, non-government organisations and governments.

3. What are lagging economic indicators?

Lagging indicators are the observer factor which changes after the economic variable with which it is correlated is changed. It changes only after the change in the economy has already taken place. It does not predict any changes in the economy; it only shows the actual results. It determines the after-change effect on the economy. Since these indicators are the outcome, they are used by decision-makers to generate signals. The best example of lagging economic indicators is the unemployment rate.