An Introduction to Revaluation Adjustments

The revaluation account format changes an asset's recorded value to more precisely represent its current market worth. A fixed asset is typically purchased and documented at cost. Businesses can decide whether to utilise the revaluation model, in which financial records are updated to reflect assets' most recent market value or to continue valuing the asset at historical cost because it is expected that the asset's market value will fluctuate over time.

The cost model only permits downward modifications to account for impairment losses. Still, the revaluation model permits both upwards and downward adjustments to represent both rises (appreciation) and reductions (depreciation) in the value of an asset.

Motives for the Reassessment

The revaluation approach might be advantageous for companies attempting to:

Get ready for the asset to be sold to another business.

Before merging with or being purchased by another firm, bargain a reasonable price.

Display the current market worth of assets, such as PP&E, whose value has grown after being purchased.

Ensure adequate resources are available to replace fixed assets when their useful lives are up.

Revaluation Account Example

Revaluation Disclosure in Accounts

The income statement shouldn't include positive revaluation when an asset's book value is raised to reflect a value increase. Instead, the revaluation excess equity account should receive credit for this gain. Up until the assets of the firm are sold, given away, or otherwise disposed of, all positive revaluations of such assets are recorded in this account.

When an asset's book value declines owing to impairment, this is known as a negative revaluation, and the loss should be written off against any revaluation surplus. It is necessary to declare the difference as an impairment loss if the loss is greater than the surplus or if there is none.

Revaluation Account Format

Depreciation and Revaluation

Depreciation should be calculated using an asset's new value after revaluation. You shouldn't adjust prior depreciation levels retroactively; this only applies to going ahead.

The most popular depreciation technique is straight-line depreciation. If you apply this strategy, the new depreciation cost will be calculated by dividing the new value by the years the asset will still be usable.

Revaluation Illustration

A company invested £10,000 on a piece of equipment in 2015 with a 10-year estimated lifespan. The firm gets acquired by a bigger corporation in 2017, so they reassessed its assets to ensure they bargain for a fair price.

It is discovered that the equipment's value has grown; it is now worth £12,000. The income statement shows a credit of £2,000 to the revaluation of assets excess account.

Given that the equipment has 8 years left in its usable lifespan, the annual depreciation expense should be £1,500: £12,000 x 8.

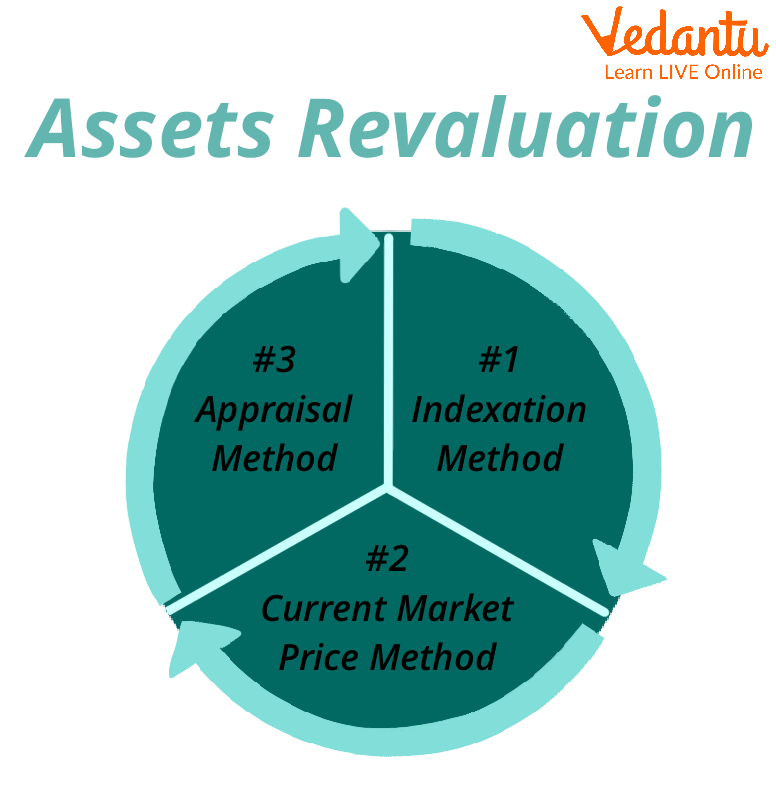

Revaluation of Assets

Revaluation of Assets and Liabilities Adjustment

The partnership firm's books of accounts must be reconciled whenever a partner leaves the partnership. The departing partner's or his legal representatives' dues must be paid. This necessitates revaluing both assets and liabilities. Let's see how the accounting is handled.

There may be specific assets and obligations that are not reflected in the records at their current values at the time of retirement or the death of a partner. Additionally, certain unrecorded assets and obligations may need entry into the records. A revaluation account is generated to determine the net gain or loss from revaluing assets and liabilities and adding unrecorded items to the books. All partners, even those retiring or have passed away, receive the Revaluation Profit or Loss in their Capital Accounts according to their prior Profit Sharing Ratio.

Conclusion

The company prepares revaluation accounts and realisation accounts for various occasions and uses. The compilation of revaluation accounts is done primarily to ensure that any profit or loss incurred belongs to the partners who were once involved in the business. Revaluation gives the present value of a company's assets, and upward revaluation is favourable; the business may charge greater depreciation on upward value and gain a tax benefit.

The company prepares revaluation accounts and realisation accounts for various occasions and uses. The compilation of revaluation accounts is done primarily to ensure that any profit or loss incurred belongs to the partners who were once involved in the business. In contrast, a realisation account is created only to determine the profit or loss the company makes or incurs while disposing of its assets and paying off its liabilities at the moment of closure.

FAQs on Revaluation Adjustments in Accounting

1. What is a Revaluation Account in the context of partnership accounting?

A Revaluation Account is a nominal account prepared during the reconstitution of a partnership firm (i.e., admission, retirement, or death of a partner). Its primary purpose is to record the changes in the value of the firm's assets and liabilities to reflect their current market values. This ensures that any profit or loss arising from such revaluation is shared by the partners in their old profit-sharing ratio.

2. Why are revaluation adjustments necessary when a new partner is admitted?

Revaluation adjustments are crucial to ensure fairness. Over time, the book value of assets (e.g., land, buildings) and liabilities may differ significantly from their current market value. It is important to adjust these values so that the incoming partner does not benefit from an undervalued asset or suffer due to an overvalued one. This process ensures that the true financial position of the firm is reflected at the time of admission, and the resulting gain or loss is attributed only to the old partners.

3. What is the standard format of a Revaluation Account?

A Revaluation Account follows the T-format of a ledger account with Debit (Dr.) and Credit (Cr.) sides. The rules are:

The Debit side records any decrease in the value of assets and any increase in the value of liabilities.

The Credit side records any increase in the value of assets and any decrease in the value of liabilities.

The final balancing figure represents either a 'Profit on Revaluation' (if Credit > Debit) or a 'Loss on Revaluation' (if Debit > Credit).

4. What are the basic journal entries for revaluation adjustments of assets and liabilities?

The key journal entries for revaluation adjustments are as follows:

For an increase in the value of an asset:

Asset A/c Dr.

To Revaluation A/cFor a decrease in the value of an asset:

Revaluation A/c Dr.

To Asset A/cFor an increase in the value of a liability:

Revaluation A/c Dr.

To Liability A/cFor a decrease in the value of a liability:

Liability A/c Dr.

To Revaluation A/c

5. How are unrecorded assets and liabilities treated through revaluation adjustments?

Unrecorded assets and liabilities must be brought into the books of accounts during revaluation. An unrecorded asset is treated as a gain and is credited to the Revaluation Account (Unrecorded Asset A/c Dr. to Revaluation A/c). Conversely, an unrecorded liability is treated as a loss and is debited to the Revaluation Account (Revaluation A/c Dr. to Unrecorded Liability A/c).

6. What is the fundamental difference between a Revaluation Account and a Realisation Account?

The primary difference lies in their purpose and timing. A Revaluation Account is prepared when a partnership is reconstituted (admission, retirement, etc.) to adjust asset and liability values while the business continues. In contrast, a Realisation Account is prepared only at the time of the dissolution of a firm to ascertain the profit or loss from selling all assets and settling all liabilities to close the business permanently.

7. How is the final profit or loss from the Revaluation Account distributed among partners?

The net result of the Revaluation Account (profit or loss) belongs to the partners who were part of the firm before its reconstitution. Therefore, the profit or loss is transferred to the Capital or Current Accounts of the old partners in their old profit-sharing ratio. A profit on revaluation is credited to the partners' accounts, while a loss is debited.

8. What is the implication if partners decide not to alter the book values of assets and liabilities during reconstitution?

If partners decide to keep the asset and liability values unchanged in the balance sheet, they can still account for the net effect of revaluation through a single adjustment entry. In this method, a Memorandum Revaluation Account is prepared to calculate the net profit or loss. Then, an adjustment entry is passed by debiting the gaining partners' capital accounts and crediting the sacrificing partners' capital accounts to settle the net effect without changing the book values.

9. From an accounting perspective, what is the importance of using current market values for revaluation adjustments?

Using current market values is important for upholding the principle of fair value accounting at the point of reconstitution. It ensures that the firm's Balance Sheet presents a true and fair view of its financial position. It prevents any undue advantage or disadvantage to incoming, retiring, or deceased partners and ensures that the appreciation or depreciation of assets over time is correctly attributed to the partners who were present during that period.