How to Calculate Compound Interest Compounded Annually

Interest is the income you receive from deposits or fees you pay on loans. Interest is of two types: Simple Interest and Compound Interest.

Simple Interest is a measure of interest that does not account for interest or accruals over multiple periods. The interest rate applies only to the principal of the loan or investment and is not affected by interest accrued.

Compound Interest is the interest on the principal and the interest accrued in the previous period. This is different from simple interest, which does not add interest to the principal when compounding interest over the next period.

Putting Money in Bank to Earn Interest

Terms Related to Interest

Some terms like Principal, rate and time used to find Interest. Let’s discuss each:

Principal: The amount borrowed from the bank by a person is called the Principal. The head is designated by the letter P.

Rate: The interest rate is the interest rate at which the principal is paid to someone over a period of time, which could be 5% or 15% etc. The interest rate is denoted by R.

Time: Time is a period given to someone on the principal amount. Time is indicated by the letter T.

Amount: When you get a loan from a bank, you must repay the principal plus interest, and this repayment is called the amount. Amount is denoted by A.

What is Compound Interest?

A modern method of calculating interest called compound interest is now used in all financial and commercial transactions all over the world. A modern method of calculating interest called compound interest is now used in all financial and commercial transactions all over the world.

Let's say we look at our bank transactions and see that interest is deposited into our account each year. This percentage changes each year by the same principal. We see increased interest in the coming years. The interest charged by the bank is compound interest or interest known as compound interest.

Compound interest is the interest applied on the amount of a loan or deposit. This is the most commonly used concept in our daily life. Compounding the amount depends on the principal and the interest received during the period. Compound interest is calculated after calculating the total amount throughout time based on the interest rate and the principal amount.

How to Calculate Compound Interest?

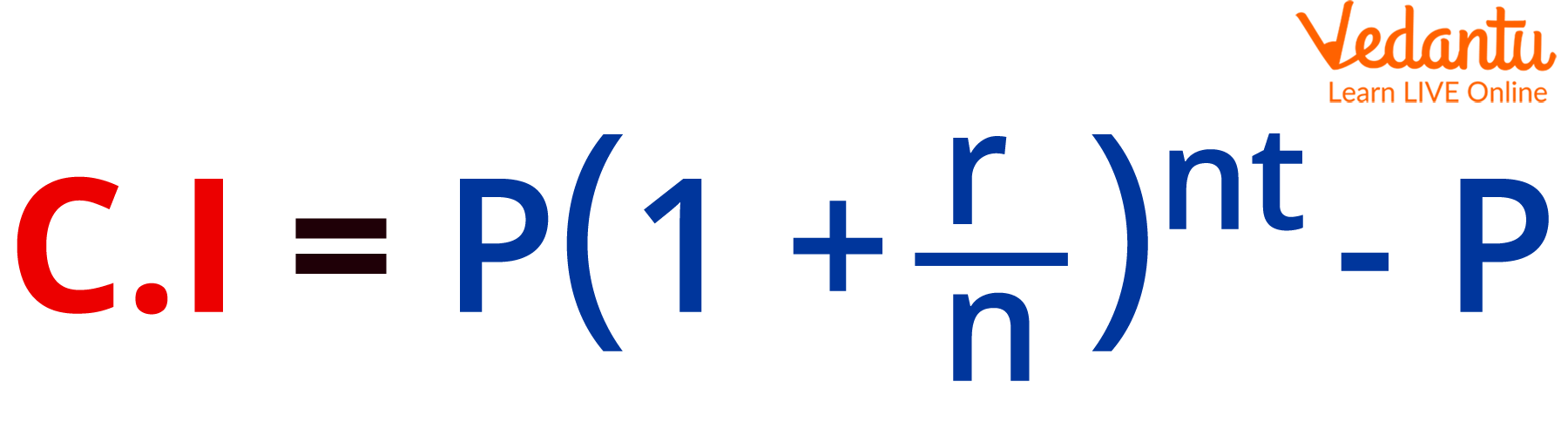

What is the Compound Interest formula? Compound Interest is calculated by using the formula:

\[CI = P{\left( {1 + \frac{r}{n}} \right)^{nt}} - P\]

Where,

P = Principal

r=Percentage rate of Interest in year

t=time taken annually

n =the compounding frequency or the number of times interest is compounded in a year.

Formula for Compound Interest

Compound Interest Formula Example

Since the compound interest is calculated annually so the time (t) taken will be 1 year so the formula for compound annual interest is:

\[CI = P{\left( {1 + \frac{r}{n}} \right)^nt} - P\]

Conclusion

Now we got our answer to the question: What is compound interest formula? Your wealth increases more quickly due to compound interest. Due to the fact that you will receive returns on both the money you invest and returns at the conclusion of each compounding period, it causes a sum of money to increase more quickly than with simple interest.

Compound Interest Formula Examples

1. If the principal is Rs. 2500 for 1 year at the rate of 15% compounded annually .Calculate compound interest.

Ans: Using the compounded annually interest formula

\[CI = P{\left( {1 + \frac{r}{n}} \right)^{nt}} - P\]

Putting value in the formula we will get:

\[\begin{array}{l}CI = 2500\left( {1 + \frac{{15}}{{100}}} \right) - 2500\\CI = 2875 - 2500\\CI = 375\end{array}\]

FAQs on Compounded Annually Formula Made Simple

1. What is the formula for calculating the total amount when interest is compounded annually?

The formula to calculate the final amount (A) when interest is compounded annually is: A = P(1 + R/100)t. Here, P stands for the principal amount, R is the annual rate of interest in percent, and t is the time period in years.

2. What does 'compounded annually' mean in simple terms?

'Compounded annually' means that the interest on your investment or loan is calculated and added to the principal amount once every year. For the next year, the interest is then calculated on this new, larger amount (original principal + the interest from the first year), not just on the original principal.

3. How do you find the Compound Interest (CI) using the compounded annually formula?

To find the Compound Interest, you first calculate the total Amount using the formula A = P(1 + R/100)t. Once you have the final amount, you subtract the original principal from it. The formula is: Compound Interest (CI) = Amount (A) - Principal (P).

4. Can you explain how to calculate compound interest with a Class 8 level example?

Certainly. Let's calculate the compound interest on ₹8,000 for 2 years at a rate of 5% per annum compounded annually.

Given:

- Principal (P) = ₹8,000

- Rate (R) = 5%

- Time (t) = 2 years

First, find the Amount (A):

A = P(1 + R/100)t

A = 8000(1 + 5/100)2

A = 8000(1.05)2

A = 8000 * 1.1025 = ₹8,820

Next, find the Compound Interest (CI):

CI = A - P

CI = ₹8,820 - ₹8,000 = ₹820.

5. Why is compound interest often called 'interest on interest,' and how does this differ from simple interest?

Compound interest is called 'interest on interest' because the interest earned in each period is added back to the principal. In subsequent periods, interest is calculated on this combined amount (principal + previously earned interest). This causes your money to grow at an accelerating rate. In contrast, simple interest is always calculated only on the original principal amount for every period, so the interest earned each year remains constant.

6. In the general compound interest formula, what value do we use for the compounding frequency 'n' when interest is compounded annually?

This is a common point of confusion. The general formula is A = P(1 + r/n)nt, where 'n' is the number of times interest is compounded per year. When interest is compounded annually, it is calculated only once a year. Therefore, the value of 'n' is 1. This simplifies the general formula to A = P(1 + r/1)1*t, which is the standard annually compounded formula: A = P(1 + r)t.

7. How does the compounded annually formula change if interest is compounded half-yearly or quarterly?

The core principle remains, but the rate and time period are adjusted based on the compounding frequency:

- For Half-Yearly Compounding: The annual interest rate is halved (R/2), and the time period is doubled (2t), because interest is calculated twice a year. The formula becomes: A = P(1 + (R/2)/100)2t.

- For Quarterly Compounding: The annual interest rate is divided by four (R/4), and the time period is multiplied by four (4t), as interest is calculated four times a year. The formula becomes: A = P(1 + (R/4)/100)4t.

8. Besides bank accounts, where else is the principle of the compounded annually formula applied in the real world?

The concept of compounding is fundamental to finance and economics. Beyond bank savings, it is used in:

- Loans: Calculating the total amount repayable on car loans, mortgages, and personal loans.

- Investments: Determining the future value of investments like mutual funds, stocks, and retirement plans (e.g., PPF).

- Economics: Modelling economic growth (GDP growth) and inflation rates over time.

- Population Studies: Estimating population growth, which often follows a compounding pattern.