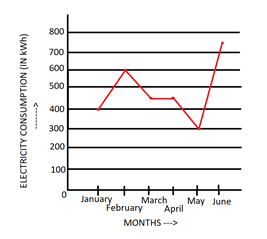

The line graph shows the amount of electricity used by Mohit for the first six months of last year. The electricity used is charged at the rate of Rs. $1.5$ per kWh for the first $400kWh$ and Rs. $0.8$ per kWh for usage beyond $400kWh$. An additional $12\% $ of the amount charged is to be paid as tax. How much did Mohit pay for the electricity used in March?

A) $Rs.696.8$

B) $Rs.403.2$

C) $Rs.700.4$

D) $Rs.716.8$

Answer

572.1k+ views

Hint: In this question, we are given a line graph which shows the amount of electricity consumed in the six months of the year. We are also given the rate of electricity at different levels of consumption and also, the tax rate. We have been asked the amount that Mohit paid in the month of March. First, check the electricity used in March. Then charge Rs. $1.5$ per kWh for the first $400kWh$. Then charge $0.8$ per kWh over $400kWh$, if any. After the amount for consumption has been calculated, charge $12\% $ on this amount as tax. The final price will include $12\% $ tax.

Complete step-by-step solution:

We are given a line graph which shows the amount of electricity consumed in the six months of the year. We are also given the rate of electricity - Rs. $1.5$ per kWh for the first $400kWh$, and $0.8$ per kWh over $400kWh$. After this, tax of C has to be levied.

We have been asked the amount that he paid for the month of March.

Let us collect the desired information.

Energy consumed in March - $450kWh$

Now, we will calculate the amount before tax.

Amount = $1.5 \times 400 + 0.8 \times 50$

$ \Rightarrow 600 + 40$

$ \Rightarrow 640$

Now, we will find $12\% $ tax on the above amount.

$12\% $ of $640$= $\dfrac{{12}}{{100}} \times 640 = 76.8$

Our final amount = $640 + 76.8 = 716.8$

Hence, Mohit paid $Rs.716.8$ in March.

Option D is the correct answer.

Note: 1) Though it is not clearly mentioned in the graph that the energy consumption is $450kWh$ but we will assume so as the marked point is in between 400 and 500.

2) We will charge Rs.$1.5$ per kWh if the energy consumption is 400kWh or less than that. If the energy consumption is more than that, Rs.$1.5$ per kWh will be charged till 400kWh and Rs.$0.8$ per kWh will be charged over 400kWh if any.

3) Tax is charged on the final amount which is to be paid. Therefore, we find the total amount first and then apply tax on it.

Complete step-by-step solution:

We are given a line graph which shows the amount of electricity consumed in the six months of the year. We are also given the rate of electricity - Rs. $1.5$ per kWh for the first $400kWh$, and $0.8$ per kWh over $400kWh$. After this, tax of C has to be levied.

We have been asked the amount that he paid for the month of March.

Let us collect the desired information.

Energy consumed in March - $450kWh$

Now, we will calculate the amount before tax.

Amount = $1.5 \times 400 + 0.8 \times 50$

$ \Rightarrow 600 + 40$

$ \Rightarrow 640$

Now, we will find $12\% $ tax on the above amount.

$12\% $ of $640$= $\dfrac{{12}}{{100}} \times 640 = 76.8$

Our final amount = $640 + 76.8 = 716.8$

Hence, Mohit paid $Rs.716.8$ in March.

Option D is the correct answer.

Note: 1) Though it is not clearly mentioned in the graph that the energy consumption is $450kWh$ but we will assume so as the marked point is in between 400 and 500.

2) We will charge Rs.$1.5$ per kWh if the energy consumption is 400kWh or less than that. If the energy consumption is more than that, Rs.$1.5$ per kWh will be charged till 400kWh and Rs.$0.8$ per kWh will be charged over 400kWh if any.

3) Tax is charged on the final amount which is to be paid. Therefore, we find the total amount first and then apply tax on it.

Recently Updated Pages

Master Class 11 Computer Science: Engaging Questions & Answers for Success

Master Class 11 Business Studies: Engaging Questions & Answers for Success

Master Class 11 Economics: Engaging Questions & Answers for Success

Master Class 11 English: Engaging Questions & Answers for Success

Master Class 11 Maths: Engaging Questions & Answers for Success

Master Class 11 Biology: Engaging Questions & Answers for Success

Trending doubts

One Metric ton is equal to kg A 10000 B 1000 C 100 class 11 physics CBSE

There are 720 permutations of the digits 1 2 3 4 5 class 11 maths CBSE

Discuss the various forms of bacteria class 11 biology CBSE

Draw a diagram of a plant cell and label at least eight class 11 biology CBSE

State the laws of reflection of light

Explain zero factorial class 11 maths CBSE