What are the Types of Goodwill?

Goodwill consists of a business's benefits to its customers, employees, and third parties. It is considered an attractive force that brings in customers. It strengthens the business's financial position to survive the competition and strategically sustains market leadership. Moreover, goodwill also opens new avenues and creates new opportunities for the business.

It represents a non-physical value over and above the physical assets. The value of goodwill is based upon the subjective judgement of the valuer.

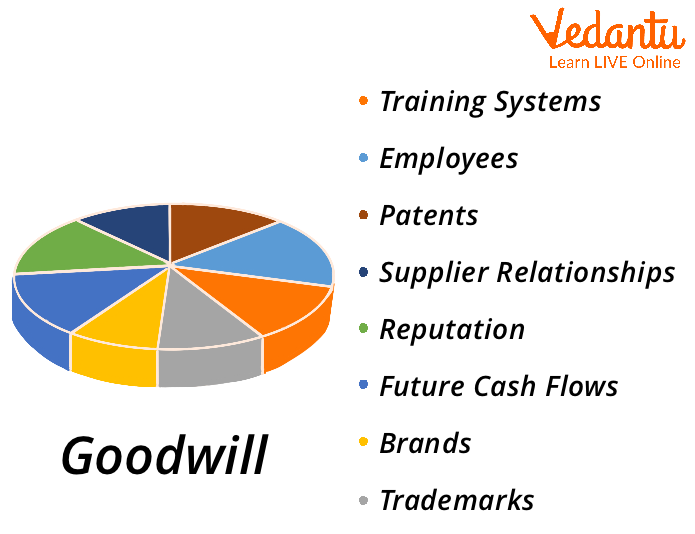

Goodwill

Goodwill Definition

Goodwill is an intangible asset combined with various business ingredients - competent management, customer satisfaction, a favourable location, a profitable product, an outstanding reputation in the market, and the expectation that these ingredients will produce an above-normal rate of return for a long period.

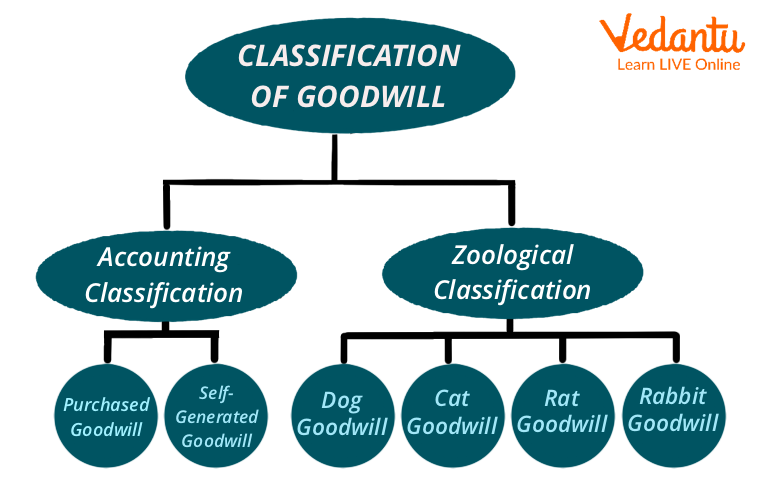

Classification of Goodwill

Classification of Goodwill

Goodwill is of two types:

Purchased Goodwill - This type of goodwill arises when another business enterprise acquires a business enterprise, and the price paid is more than the net assets acquired.

Non-purchased Goodwill - This arises when a business generates its goodwill over time due to factors like location, good management, quality products, and good sales policies.

According to P. D Leake, goodwill is also classified as:

Dog Goodwill - Dogs are loyal and faithful. In this type of goodwill, customers are more attached to the persons conducting the business rather than the place of the business.

Cat Goodwill - This type of goodwill is considered best. In cat goodwill, the customers are loyal to the brand or the organisation. The persons who conduct business don’t concern them.

Rat Goodwill - In this type of goodwill, customers are not attached to a person or place and are casual in their behaviour. This is also known as fugitive goodwill.

Rabbit Goodwill - In this type of goodwill, customers will buy the product if it is available in their acceptable radius. They are more concerned about the nearness of the place.

What has Purchased Goodwill?

Purchased goodwill is the difference between the value paid for a business enterprise and the sum of its total assets less the sum of its total liabilities. Such goodwill is recognised and is shown in the Balance Sheet.

Features of Purchased Goodwill

It arises only from the purchase of the business.

Its cost could depend on future maintainable profits.

Factors such as market reputation, economies of scale, and fiscal advantages contribute to the value of goodwill.

What Is Self-Generated Goodwill?

Self-generated goodwill is the business's value over its net assets' fair value. This is also known as raised or inherited goodwill. This type of goodwill is not shown in the Balance Sheet.

Features of Self-generated Goodwill

It is internally generated.

No cost can be placed on it.

The value is based on the subjective judgement of the valuer.

Circumstances for Valuation of Goodwill

The following are the situations when goodwill is valued:

In the case of a sole trader, when the business is sold or a new person is admitted to the firm, the firm becomes a partnership firm.

In the case of a partnership firm, when there is a change in the profit-sharing ratio on admission, death, and retirement of a partner.

In the case of a joint stock company, the need for valuation may arise in the following cases:

When the company's business is sold to another company or when the company is amalgamated with another company

When the company has previously written off goodwill and wants to write it back in the books

When the stock exchange quotations are unavailable, shares must be valued for taxation purposes

Conclusion

In a nutshell, goodwill is described as momentum or a push that keeps the business going without further effort. It helps a business enterprise to earn greater profits than the returns normally to be expected on the capital represented by the net tangible assets employed in the business. It is the most unrealisable form of the asset as it can be disposed of only in the event of the business being sold.

FAQs on Goodwill: Meaning and Valuation

1. What is the basic meaning of 'goodwill' in accounting?

In accounting, goodwill is an intangible asset that represents the good name, strong brand reputation, and positive customer relationships of a business. It's the value a company has beyond its physical assets, which allows it to earn profits above the normal industry average.

2. What are the key factors that can increase or decrease a firm's goodwill?

Several factors can influence a company's goodwill. Some of the most important ones include:

- Favourable Location: A business located in a prime, easily accessible area tends to attract more customers.

- Quality of Products/Services: Consistently offering high-quality goods builds customer loyalty and a strong reputation.

- Management Efficiency: Experienced and skilled management leads to better operational efficiency and higher profits.

- Good Customer Relations: Excellent service and a positive relationship with customers contribute significantly to a firm's good name.

3. Why is it necessary to calculate the value of a firm's goodwill?

Valuing goodwill is essential whenever the financial structure or ownership of a partnership changes. It ensures fair treatment for all partners regarding the firm's reputation and earning capacity. The need for valuation typically arises during the admission of a new partner, the retirement or death of an existing partner, the sale of the firm, or a change in the profit-sharing ratio among partners.

4. What are the main methods used to value goodwill in a partnership?

There are three primary methods used for the valuation of goodwill:

- Average Profit Method: Goodwill is calculated based on the average profit of the past few years, multiplied by an agreed number of years' purchase.

- Super Profit Method: This method considers the 'super profit', which is the excess of a firm's average profit over the normal profit earned by similar firms.

- Capitalisation Method: Under this method, goodwill is found by assessing the capital needed to generate the average profit and comparing it to the actual capital employed.

5. What is the main difference between purchased goodwill and self-generated goodwill?

The key difference lies in how they are created and recorded. Purchased goodwill is acquired when one business buys another and pays a price higher than the value of its net assets. This type is recorded in the balance sheet. In contrast, self-generated goodwill is built up over time through a firm's own efforts, like building a strong brand and customer base. As per accounting standards, this type of goodwill is not recorded in the books of accounts.

6. Can you explain the concept of 'hidden goodwill' and when it is calculated?

Hidden goodwill, also known as inferred goodwill, is not explicitly mentioned in the partnership agreement. Its value is calculated at the time of a new partner's admission. It is inferred from the new partner's capital contribution and their profit share. You find it by first calculating the total capital of the new firm based on the new partner's investment, and then subtracting the actual combined capital of all partners.

7. How does the 'super profit' of a firm relate to its goodwill valuation?

Super profit is the profit a business earns over and above the normal profit expected in its industry. It directly reflects the firm's extra earning capacity, which is attributed to its goodwill. The logic is that a business with a good reputation will earn more than its competitors. Therefore, in the Super Profit Method, goodwill is calculated as a multiple of this extra profit, representing the value of that competitive edge.

8. Is goodwill considered a tangible or an intangible asset?

Goodwill is classified as an intangible asset. This is because, unlike tangible assets such as machinery or buildings, it has no physical form that you can see or touch. However, it still has a real, measurable value that contributes to the company's success.