An Introduction of Retained Earnings

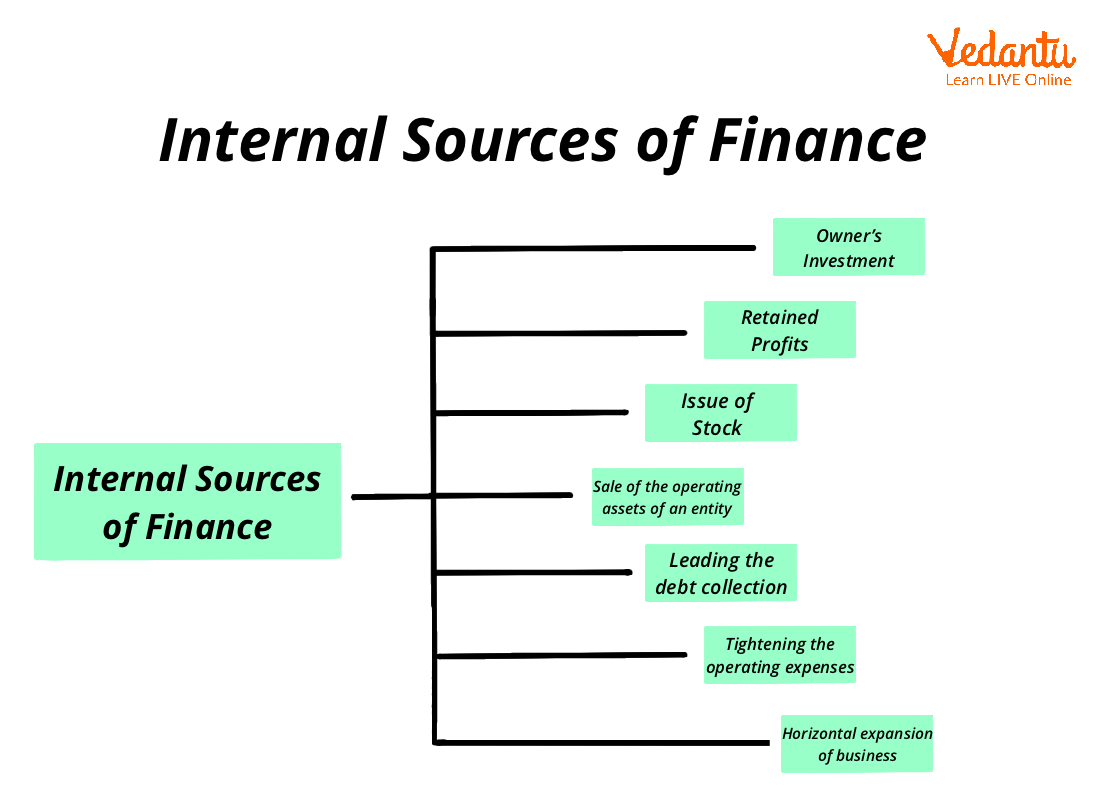

Retained earnings are the earnings that remain with the company after the distribution of dividends to shareholders. In the event of a net loss in any financial year, a company cannot pay dividends. The benefit of retained earnings is that it is shown on the balance sheet as shareholders' equity. It is also referred to as the earnings surplus. Retained earnings are an internal source of financing as their profits were retained by the company after all expenses.

Prerequisite for Growth

Features of Retained Earnings

Zero Cost of Financing: The first and most important feature of retained earnings is that it is a zero cost of financing for the company because the company does not have to pay any interest, which is the case when the company raises funds through borrowings.

Flotation Cost: Unlike other forms of financing, using retained earnings helps to avoid issue-related costs.

Control: The use of retained earnings avoids the possibility of existing shareholders' control changing or being diluted as a result of the issuance of new issues.

Legal Requirements: The use of retained earnings is not subject to legal requirements. It only takes a resolution to be passed at the company's annual general meeting.

Retained Earnings Internal source of Finance

Merits of Retained Earnings

Retained earnings are a continuous source of funds for an organisation.

There is no explicit cost in the form of interest, dividends, or floatation costs.

Because funds are generated internally, there is more operational freedom and flexibility.

It improves the company's ability to absorb unexpected losses.

It may increase the market price of a company's equity shares.

Demerits of Retained Earnings

There is unequal growth because undistributed profits remain concentrated in the same industry.

Because business profits fluctuate from time to time, it is an uncertain source of funds.

Excessive retained earnings cause shareholder dissatisfaction because it reduces the dividends payable to them.

Reserves may be overcapitalised as a result of frequent capitalisation.

Many businesses fail to recognise the opportunity cost of these funds. As a result, the funds are used inefficiently.

Factors Affecting Retained Earnings

Net income/losses have a direct impact on the entity's retained earnings.

Dividend payments made to the entity's shareholders during the year reduce the accumulated earnings.

Sales growth is essential because it directly affects net income. If sales increase with a positive gross profit margin, the entity will profit. These elements have a significant impact on net income. It also has an impact on accumulated earnings.

The cost of goods sold has a direct impact on net income; if it rises or falls in step with sales, net income will fall into line and affect earnings.

Depending on the entity's financing plan, interest costs may vary. Some businesses may decide to finance their operations with loans, while others may decide to do so with equity. The entity will incur high-interest costs if it has high levels of financial leverage and borrowing. Retained earnings will be impacted by this.

Case Study

1. XYZ company has been running a financial consultancy firm for the last 7 years. The company then became very reputed and had good goodwill. It has sufficient profit reserves accumulated over the previous 7 years. He now intends to open branches in Pune and Delhi. No additional liability is desired for expanding business. In the above-mentioned situation:

Recommend a suitable source of funding for XYZ.

Explain any three characteristics of retained earnings.

Ans:

A) The best suitable source of funding would be retained earnings. Retained earnings are the earnings that remain with the company after the distribution of dividends to shareholders. So, the company has accumulated profits from the last 7 years so that can be reinvested in opening new branches.

B) The three characteristics of retained earnings are listed below:

Funds for New and Innovative Projects: They are a popular source of funding for risky and innovative projects. They are commonly used for research and expansion projects.

They are considered an ownership fund for medium and long-term finance. It is used for medium and long-term financing.

Retained earnings are a zero cost of financing option. It means that the company does not have to pay any interest on it.

Conclusion

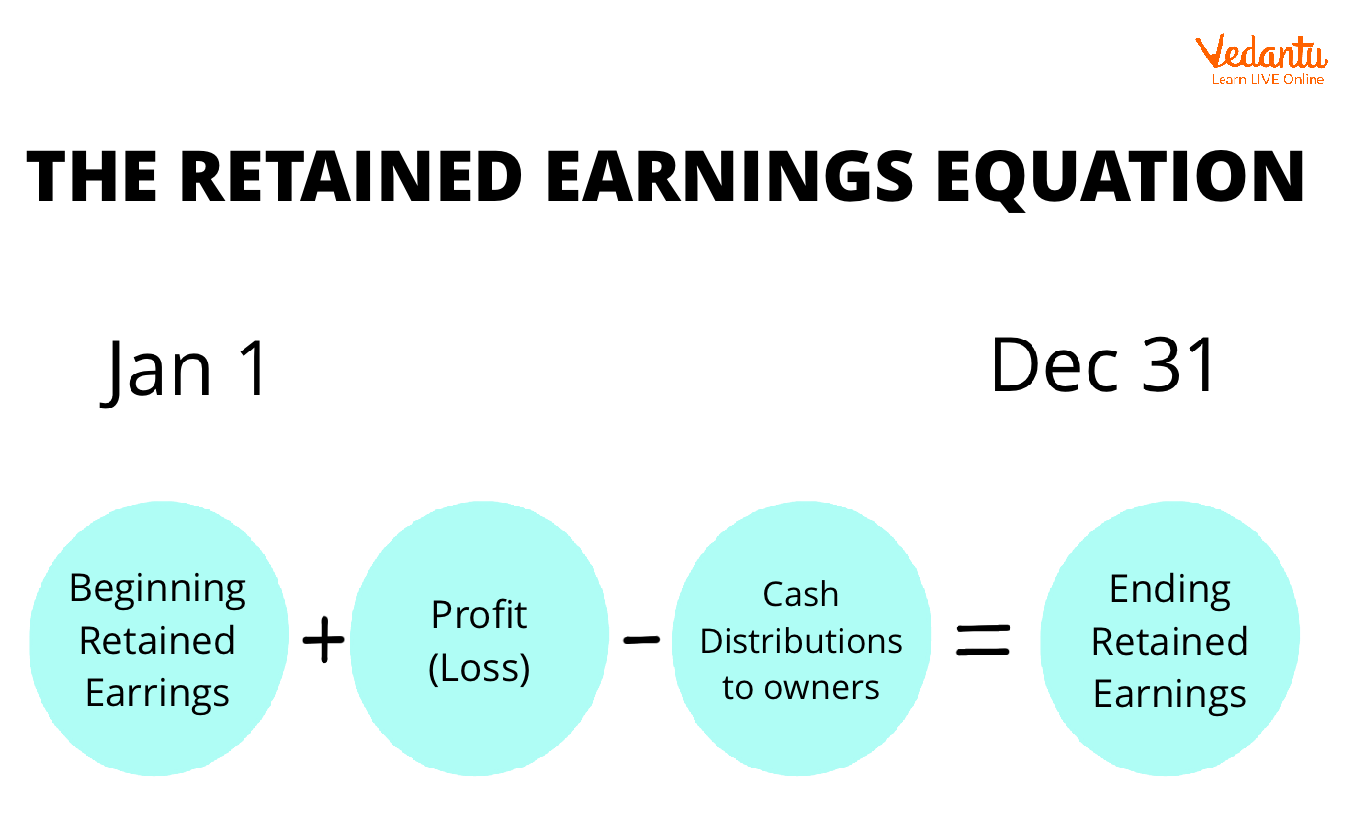

Retained earnings is the money kept aside for the business rather than paying to the shareholders. Retained earnings are also referred to as trading profits or earnings surplus. It's a type of equity that helps in measuring the financial stability of the company. Retained earnings are an important part of any business. Retained earnings are an internal source of financing. They are a continuous source of funds and have the ability to absorb unexpected losses. Retained earnings can be represented as:

Retained Profits / Retained Earnings=Net Profits - Dividend / Drawings

Here, Net Profits is the amount remaining after deducting expenses from revenue.

How to Calculate Retained Earnings

FAQs on What Are Retained Earnings? Concept Explained

1. Give one characteristic of retained earnings that the other source of finance lacks. Why is it important to keep earnings?

A portion of net income is saved as retained earnings for use in the future. Retained earnings have no definite costs and can support themselves. These earnings are easily accessible, so the business does not need to ask its shareholders or lenders for financial assistance in an emergency. Utilising retained earnings lowers the price of issuing external equity and eliminates underpricing losses.

It is important to keep earnings because retained earnings boost the company's capital and give it money for expansion. A company may reinvest a portion of its earnings in its expansion strategies. The shareholders of a company invest in the business in the hopes of making a profit.

2. Which of the following are the three components of retained earnings?

Retained earnings are made up of three elements. First, based on accumulated earnings since their beginning, all corporations older than one year have a retained earnings balance. The second is the net income after taxes for the current year. Any dividends paid to stockholders or owner withdrawals, not salaries or wages, make up the third factor.

3. Are retained earnings a current asset for the organizations?

No, for accounting purposes, retained earnings are not a current asset. Any asset that will bring about financial gain for or within a year is considered a current asset. Retained Earnings are the net income accumulated over time and used to pay dividends to shareholders or compensate shareholders if the corporation is sold or purchased. Retained earnings are, therefore, not a company asset because they belong to the shareholders. It is held by an Entity as additional equity shareholder funding.

4. Briefly describe the concept of Retained Earnings.

Retained earnings are a company's cumulative net earnings or profits after dividend payments. The term "retained" captures the fact that those earnings were not paid out to shareholders as dividends but were instead retained by the company as an important accounting concept. Retained earnings are affected by several factors like sales growth, net income/losses. As a result, retained earnings fall when a company loses money or pays dividends and rises when new profits are generated.

5. Retained Earnings are which source of financing?

Retained earnings are a steady source of funds for a business. It is a source of internal funding. The most common source of internal financing for a business is retained earnings. Retained earnings are a company's profits that are not distributed to shareholders as dividends but are instead reinvested to fund new projects or ventures. Thus helps the businesses to expand and grow. It also allows the company to absorb the losses that occurred previously and helps in increasing the market price of the equity shares.