Master Introduction To Accounting Class 11 Questions And Answers For Better Exam Results

FAQs on NCERT Solutions For Class 11 Accountancy Chapter 1 Introduction To Accounting (2025-26)

1. How can one download the introduction to accounting NCERT PDF solutions for Class 11?

Visit the Vedantu NCERT Solutions page for Class 11 Accountancy Chapter 1. Locate the "Download PDF" button and click it to save the file. Use this for offline access to all questions and answers, ensuring you can study anywhere, anytime without an internet connection.

2. How do you identify a business transaction in accounting?

Identify any economic event that changes the financial position of a business, involving assets, liabilities, or equity. Ensure it is measurable in monetary terms. For example, purchasing goods for cash is a transaction, but a manager's skill is not, as it cannot be monetarily valued.

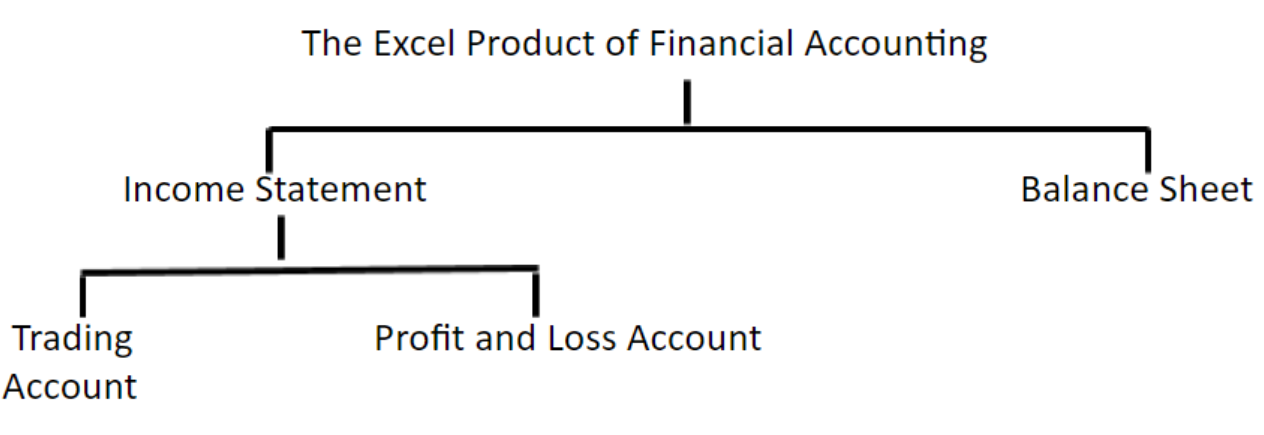

3. What is a simple way to distinguish an asset from a liability?

Define an asset as a resource the business owns that provides future economic benefit (e.g., cash, machinery). Define a liability as an obligation the business owes to others (e.g., loans, creditors). An asset adds value; a liability is a claim on assets.

4. How can one use NCERT solutions for a quick revision of Chapter 1?

Scan the solutions for key definitions and solved problems. Focus on the final answers of numerical questions to quickly check your own work. This helps reinforce concepts from the class 11 accountancy chapter 1 question answer section without re-reading the entire chapter.

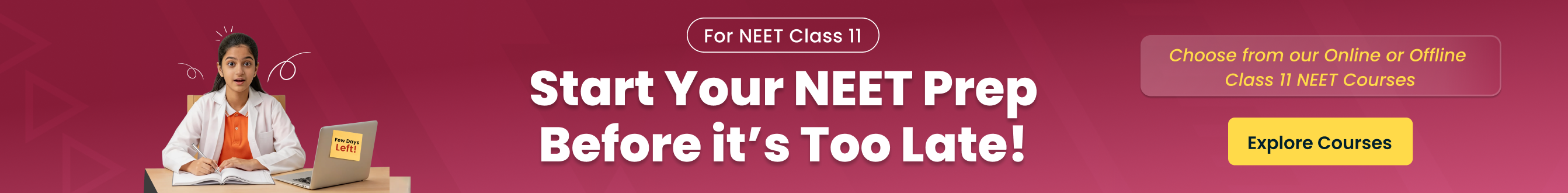

5. What is the primary objective of accounting?

The main objective is to systematically record financial transactions and events to ascertain the profit or loss for a period and the financial position of the business on a specific date. This information is then communicated to interested users like investors and management.

6. How should one use the NCERT Solutions for Class 11 Accountancy Chapter 1 to practice different types of questions?

Use the NCERT Solutions for Class 11 Accountancy Chapter 1 by first attempting all the exercise questions from the textbook on your own. This helps you identify areas where you need more clarity.

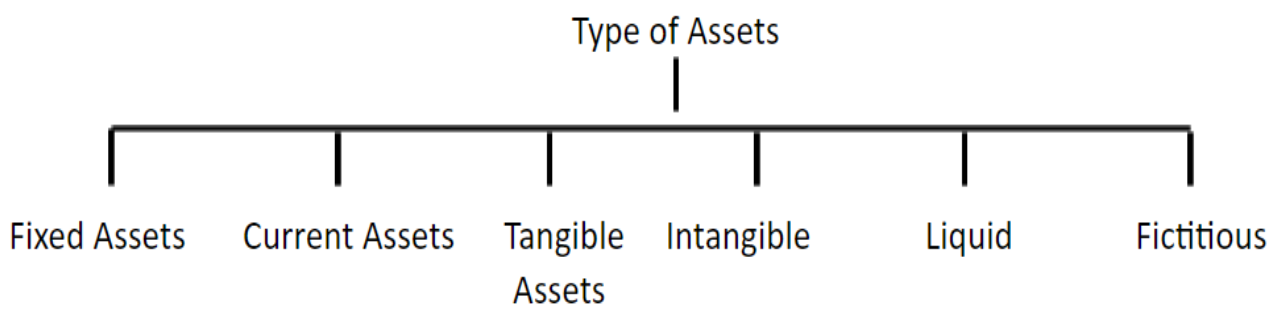

7. How can one explain the four qualitative characteristics of accounting information?

Explain the qualitative characteristics by defining each one and providing a simple business context. These characteristics—Reliability, Relevance, Understandability, and Comparability—are the attributes that make accounting information useful to its users.

Reliability: Describe it as information that is free from error and bias, meaning it is verifiable and factual. For instance, a sales invoice backs up a revenue entry.

Relevance: Explain that information is relevant if it influences the decisions of users, helping them predict outcomes or confirm past evaluations.

Understandability: Define this as information presented in a clear and concise manner so that users with reasonable business knowledge can comprehend it.

Comparability: Explain that information must be comparable over time and with other businesses to identify trends and performance benchmarks.

8. What is an effective way to use the Free PDF of NCERT Solutions for offline study?

Download the Free PDF to create a dedicated study resource that you can access on any device without needing an internet connection. This is perfect for focused, distraction-free learning sessions.

Once downloaded, integrate the PDF into your study routine. Use it alongside your NCERT textbook to cross-reference questions and answers instantly. This makes it easier to tackle the introduction to accounting questions and answers class 11.

9. What are the steps to define the role of accounting in a modern business?

Define the role of accounting by breaking it down into its core functions, which extend beyond simple bookkeeping. Accounting acts as the language of business, providing critical information for decision-making, control, and legal compliance.

Understanding its role helps appreciate why introduction to accounting class 11 NCERT solutions focus on systematic recording and reporting. It shows how accounting supports business strategy.

10. How does one determine if an event is a financial transaction that should be recorded in accounts?

Determine if an event is a recordable financial transaction by applying the "money measurement concept." An event must meet two key criteria to be recorded in the books of account.

First, check if the event affects the financial position of the business (i.e., changes the value of assets, liabilities, or capital). Second, ensure this change can be measured and expressed in monetary terms.